Jan 17, 2026

𝄪

Equity Research Reports

𝄪

How LLMs and Claude Cowork will affect the online travel advisor industry - ABNB Long / Booking.com Short

Trade Report for a market neutral Long/Short

Long AirBnB (ABNB) Short Booking.com (BKNG)

Date: January 17, 2025

Recommendation: Long ABNB/Short BKNG

Target Price: FY26: ABNB $152.58 (+16%) / BKNG $3616.69 (-29.3%)

Investment Thesis

We are long AirBnB and short Booking.com because generative AI will disrupt these businesses asymmetrically, destroying value for aggregators while leaving platforms with unique supply largely untouched. The trade exploits a structural difference. Booking.com aggregates hotel inventory that exists elsewhere and can be accessed by AI directly, while AirBnB offers nearly 8 million listings, often available nowhere else. Large language models from OpenAI and Anthropic can now perform Booking's core functions: searching hotel inventory across multiple sources, comparing prices, and presenting options. When someone asks ChatGPT or Claude to find a hotel in Paris, the AI queries brand websites like Marriott.com, Google Hotel Search, and OTAs simultaneously, aggregating more comprehensively than Booking's interface. Booking's moat is weakening because it doesn't own the underlying supply. The same properties are available directly from hotel chains, often at identical or better rates for loyalty members. When AI searches all sources at once and selects the best option, Booking's role as intermediary becomes less effective. BKNG trades at ~20x forward earnings with adj. EBITDA margins around 37%, maintained through transaction take rates and advertising revenue from hotels competing for placement. Mizuho's research suggests a 1% shift in booking share corresponds to roughly a 2% decline in earnings. Even modest AI adoption of 2-3% of total volume would reduce Booking's EPS by 4-6%. To defend traffic share, Booking must increase customer acquisition spending precisely as AI-driven search reduces the effectiveness of paid channels. Revenue declines while customer acquisition costs rise, compressing top and bottom lines.

AirBnB presents the opposite dynamic because it offers supply that is unique. The platform's ~8 million listings often exist exclusively on AirBnB, with hosts locked in by network effects and specialised tools. When users ask AI to find apartment rentals in Barcelona, the AI doesn’t pull inventory from as many competing sources because there simply aren’t many. Instead, AI directs users to AirBnB, making it a necessary destination rather than an optional layer. AirBnB's supply moat means AI likely strengthens its position by funnelling searches toward the only platform that can fulfil them. The company can also integrate AI into its own product to improve recommendations without facing existential pressure from external agents replacing its core function.

There are several catalysts to see this thesis unfold. First, new models and tools now enable agent-based task automation. Perplexity offers agent tasks for research and booking workflows. Claude's cowork tool can schedule and execute multi-step processes. Most recently, projects like Clawdbot provide complete system access for proactive automation of complex tasks, including travel planning and booking. These tools are already live and functional today. Second, corporations are incorporating these models into operations to capture ROI from AI investments. Businesses automating internal processes, including travel booking, bypass OTAs as a direct consequence. Enterprise adoption represents significant volume for Booking, particularly in the corporate travel segment, which was historically considered sticky revenue. The metrics to monitor include Booking's corporate booking volumes, website traffic originating from AI, and adoption rates of AI-driven process automation within businesses.

The trade targets multiples compression as the market reprices Booking from a strong moat platform to a disintermediated aggregator facing secular decline. Booking.com trades at 19.3x forward earnings, a premium that assumes continued margin expansion and market share stability. Our model suggests a 12-14x forward P/E reflects appropriate valuation. The dual impact of multiple compression and EPS erosion amplifies the downside. A re-rating translates to a potential downside to the current share price of up to -35%. AirBnB trades at 27-28x forward earnings, below its 32-34x historical average. We see the long leg working in three ways. First, AirBnB's multiple could expand to historical averages as investors recognise the supply moat insulates it from AI disruption, unlike pure aggregators. Second, the company can maintain its current valuation while growing its earnings base as operational leverage improves with scale.

COMPANY OVERVIEWS

Booking.com

Booking.com operates at a massive scale with $185B in gross bookings across 1.2B room nights, generating $26.7B in revenue in 2025. The business splits into merchant bookings (66% of revenue, 13.6% take rate), agency bookings (30%, 14.2% take rate), and advertising (4%). Consensus projects revenue growth decelerating to 10% in 2026 and 7% in 2027, but we expect lower growth meaningfully as AI disruption reduces traffic as users shift from traditional search to AI answer engines. We project revenue growth will decelerate to 7% in 2026 and 6% in 2027, below consensus expectations of 9% and 8%, on the back of traffic being directed away from Booking.com. Marketing spend, currently running at $8.0B annually, or 4.3% of gross bookings, will be impacted as well. As traffic quality deteriorates, Booking.com will have to increase spending to maintain growth, driving the % of gross bookings ratio up. The company maintains 36.9% adjusted EBITDA margins today, with consensus projecting expansion to 37.6% in 2026. We see the opposite with margins compressing to 34-35% in 2026 as marketing spend rises.

AirBnB

Airbnb operates on exclusive inventory: $90B in gross bookings across 528M nights, generating $12.2B revenue at a 17.9% take rate in 2025. The 8 million active listings exist mostly only on its platform. This exclusivity creates pricing power versus Booking's 13.6-14.2% on commoditised hotel supply. Analysts project the take rate will hold as the company scales, driving revenue to $13.5B in 2026 and $14.6B in 2027 (10% annual growth). The company maintains 35% adjusted EBITDA margins with lower marketing dependency than traditional OTAs. Analysts project margins expanding to 35.4% in 2026 and 36.3% in 2027 as experiences and services scale. Reserve Now Pay Later, introduced in Q3 2025, is adding 1 percentage point to bookings growth and 2-3 percentage points to EBITDA growth in 2026. The policy drove 100-200 basis points of US gross bookings uplift in Q3 with 70% adoption among eligible guests.

Valuation

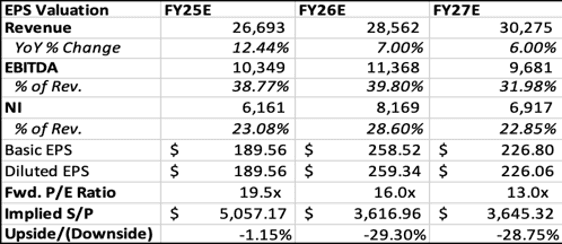

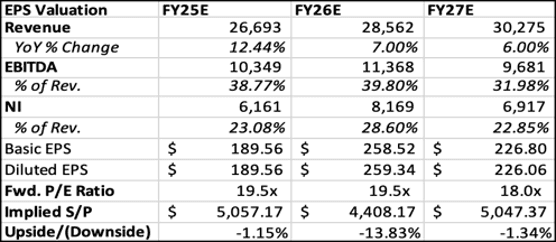

Booking.com

Based on our different views on top-line and marketing expense growth over the next 2 years, as outlined above, and the multiple compression, we are pricing in a downside in the stock of around -30% based on an EPS & P/E valuation and up to -35% using a DCF valuation. Even if the market does not regrade the stock’s multiple as aggressively as expected, based on our differing estimates, we still see downside in the stock.

AirBnB

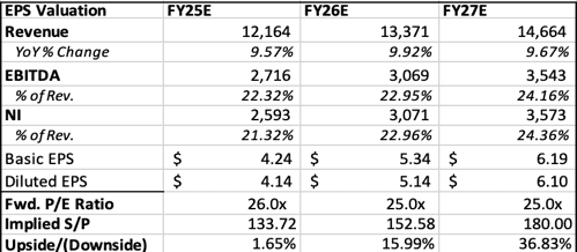

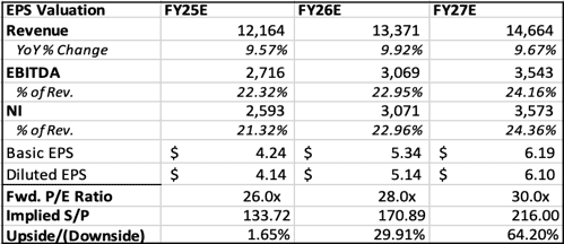

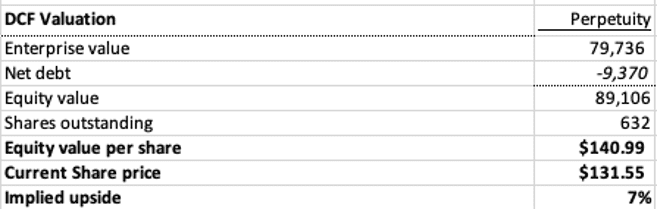

DCF valuation suggests 7% upside. EPS/P/E analysis shows 30% upside assuming flat multiples, expanding to 60% upside if ABNB reverts to historical average multiples. Combined with the BKNG short leg, the pair trade offers 37% potential return in the moderate scenario by FY27, reaching 90% in the optimistic case with multiple re-rating.

Trade Risks

Booking.com: AI disruption thesis doesn't materialise

Revenue Growth Holds Despite AI Shift

We project revenue growth decelerating to 7% in 2026 and 6% in 2027 as AI answer engines reduce traffic quality. Consensus expects 9% in 2026 ($29.1B) and 8% in 2027 ($31.5B). Current performance shows Q3 2025 revenue up 9.7% with room nights up 8.2% and gross bookings up 14% constant currency. This represents deceleration from 12.4% full-year growth in 2025, but if growth stays above 9% through the first half of 2026, our timing is wrong. We will critically watch the first 2-3 earnings releases of 2026. If revenue growth prints above 10% sustainably, the AI impact is either delayed or less severe than expected.

Marketing Efficiency Doesn't Deteriorate

We project marketing spend rising from 4.3% to 5-6% of gross bookings, compressing EBITDA margins from 36.9% to 34- 35% in FY27. Consensus expects margins expanding to 38.5% by 2027. Q3 2025 showed $2.34B marketing on $49.6B gross bookings, a 4.7% ratio, already 40 basis points worse than last year. As this could be seasonal noise, if numbers in H1- Q3’26 show the ratio back at 4.3% or declining below 4.2%, our margin compression thesis fails. The most dangerous scenario would be if Booking continues to strike strong partnerships that channel LLM traffic towards Booking.com, with the booking done on the website. This, depending on the structure of the deals, could actually decrease marketing spend.

AI Adoption Slower Than Expected

Our thesis assumes that AI search becomes more prominent, especially among corporations, in 2026-2027. If AI adoption is delayed, the trade's time horizon extends and opportunity cost rises.

AirBnB: Idiosyncratic business underperformance due to regulatory issues.

The main risks for the long AirBnB leg are of idosyncratic nature, as AirBnB would not be negatively impacted if the AI thesis doesn’t work out. Regulatory crackdowns represent the primary threat, with active listings at 8 million growing 9% in 2024. Major cities like New York, Paris, Barcelona, and Amsterdam have histories of short-term rental restrictions that could intensify, permanently reducing available inventory. We would watch for sustained negative listings growth or accelerating regulatory action across multiple geographies. Core market saturation creates the second risk, with North America (31% of nights) and EMEA (41% of nights) combining for 72% of the business. If combined NA+EMEA growth decelerates materially below current rates while new initiatives fail to scale meaningfully, the business faces growth deceleration. Take rate compression from competition presents the third risk, with Airbnb's 17.9% rate providing a 400-500bps cushion versus Booking's 13.6-14.2%. If Airbnb decides to drop the take rate below 17% due to competitive pressure intensifying, this would signal structural margin pressure.

Entry and Exit Framework

Entry is immediate. The thesis relies on AI disruption in the coming months/years. Given our market-neutral positioning and current betas of ABNB and BKNG, we should Buy/Sell in a 1.07:1 ratio.

Stop Loss Levels

Position management operates on two levels. If the fundamental numbers discussed in the risk assessment section don’t evolve according to our expectations, we reconsider the thesis and potentially reduce position size. For Booking, this means revenue growth staying above 9-10% and marketing ratios holding at 4.3% or declining through H1-Q3 2026. For Airbnb, this means active listings growth turning negative, having to drop take rates noticeably, or core market deceleration while new products fail to scale. Technical risk management provides the second layer, using VaR and CVaR to monitor both legs. If divergence widens beyond acceptable risk parameters, technical measures prompt thesis reconsideration and position adjustments independent of fundamental developments.

Take Profit Levels

The primary exit target is Booking's multiple compression from the current 19.7x 2026 P/E. This represents the core thesis of AI disruption, forcing margin compression and valuation contraction. We close the full position when this target is reached. As Airbnb rallies during the trade, we can take partial profits, but we maintain exposure if the multiple compression on BKNG hasn't materialised. The trade generates returns from spread widening in either direction, though Booking downside remains the primary expected driver. Based on our VaR levels, we also consider profit-taking at 2:1 or 3:1 risk-reward ratios as technical overlays, capturing gains if the market moves aggressively.

Factor Exposure

We ran a Fama-French 5-factor regression on BKNG and ABNB and found no statistically significant factor loadings beyond market beta. This means the position adds no meaningful systematic risk in terms of size, value/growth, profitability, investment, or momentum factors.

—

Author: Florian Link

FOOTNOTE

© 2026 TLG Research. All rights reserved. Unauthorised use and/or duplication of this material without express and written permission from this blog’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to [Your Name] with appropriate and specific direction to the original content. Disclaimer: The content provided on this blog is for educational and informational purposes only and does not constitute financial, investment, or trading advice. The author is not a financial advisor. All trading involves a high level of risk and may not be suitable for all investors; do not trade with money you cannot afford to lose. Past performance is not indicative of future results.