Dec 1, 2025

𝄪

Trade Review

𝄪

PLTR HTF Range Breakout Playbook: 27/11/25-03/11/25

PLTR Long Trade Review

HTF Trade Setup

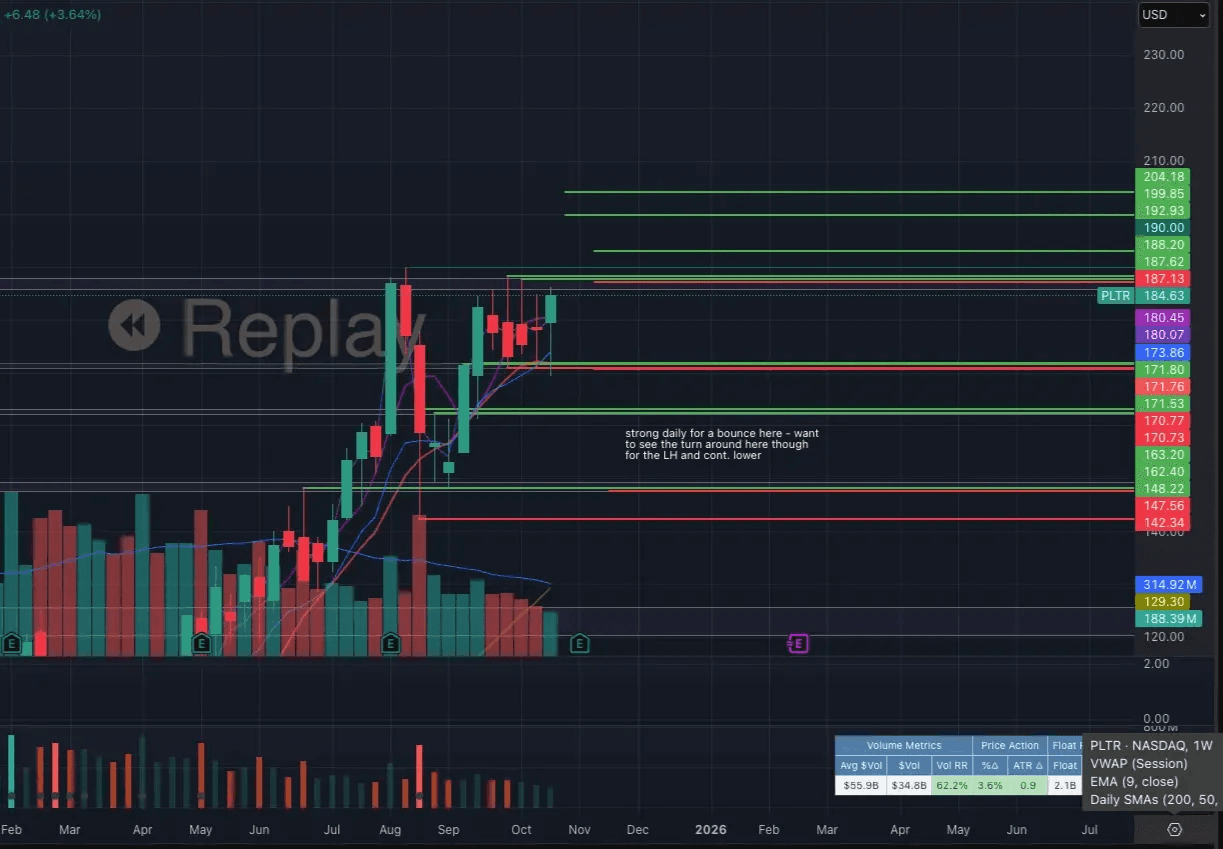

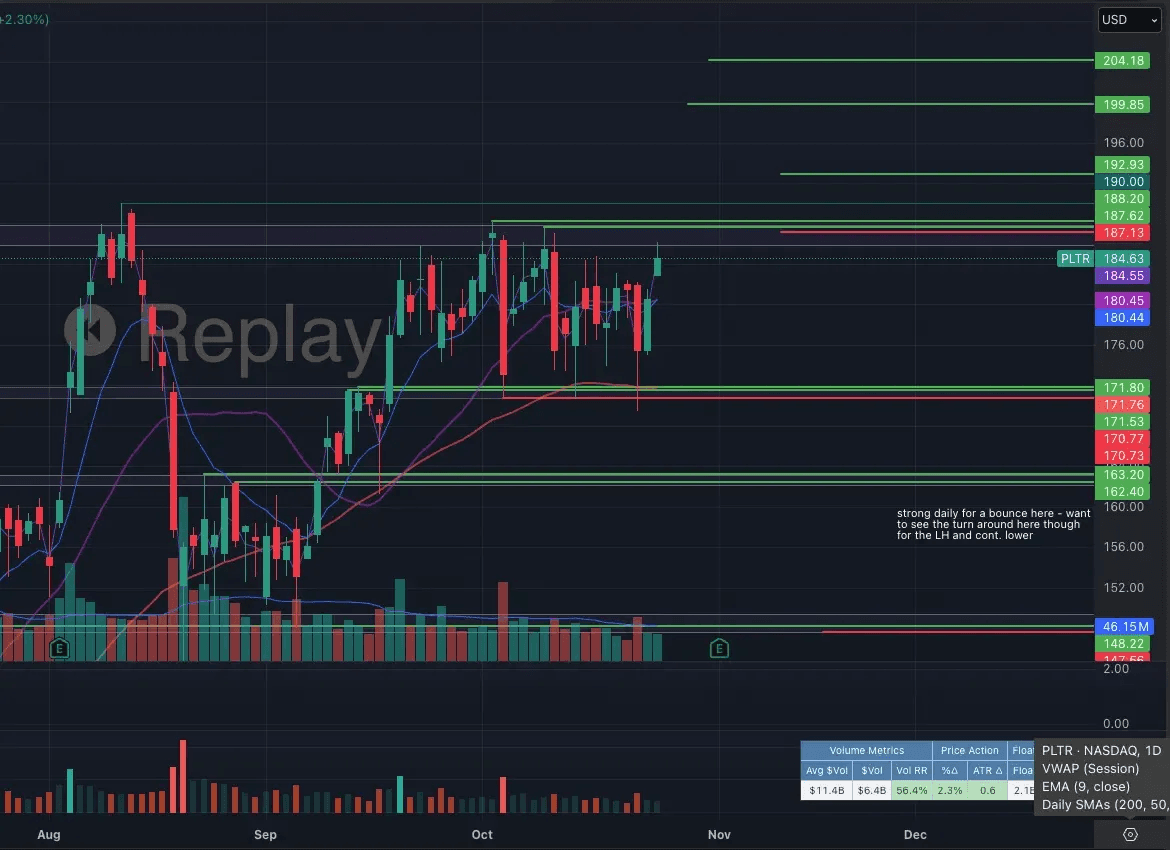

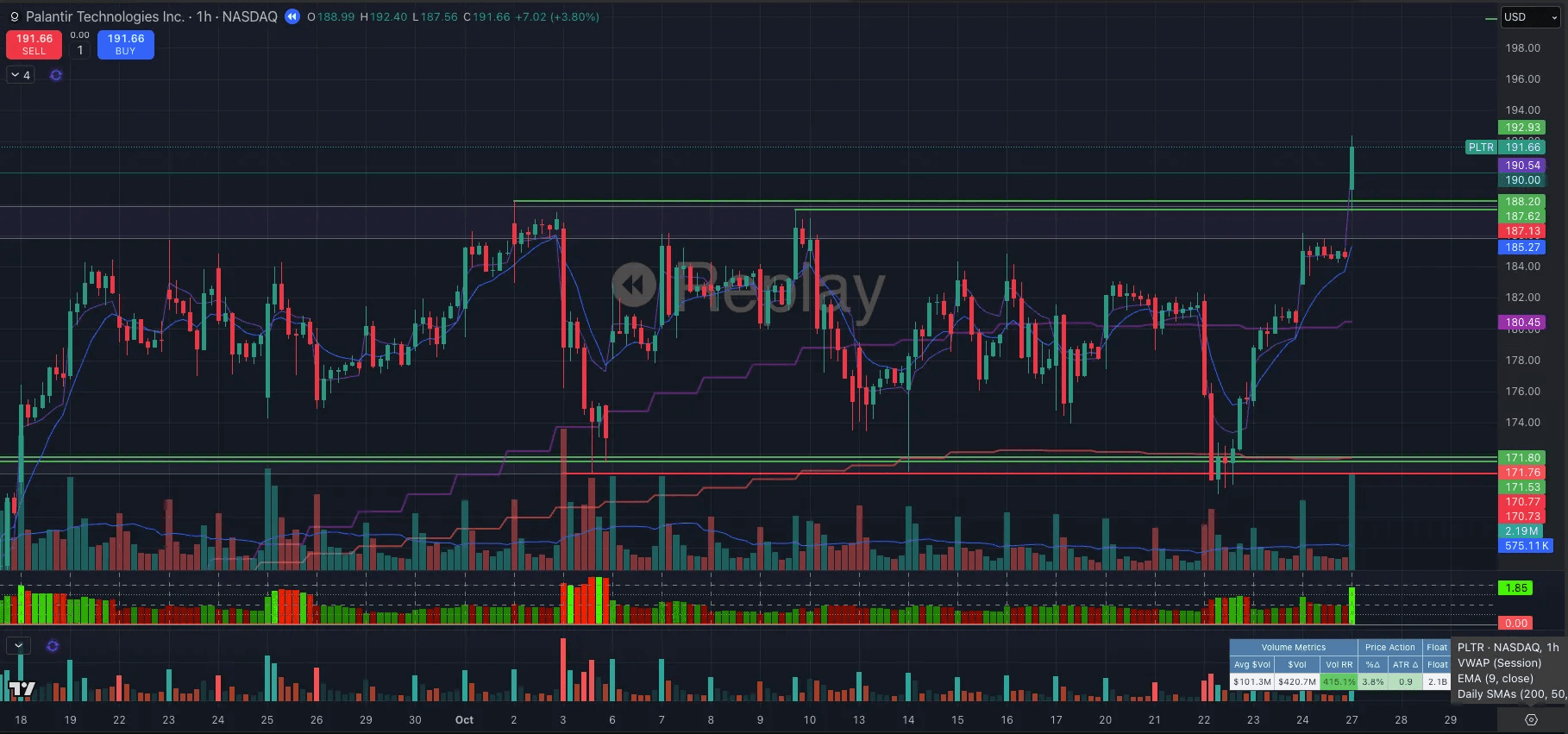

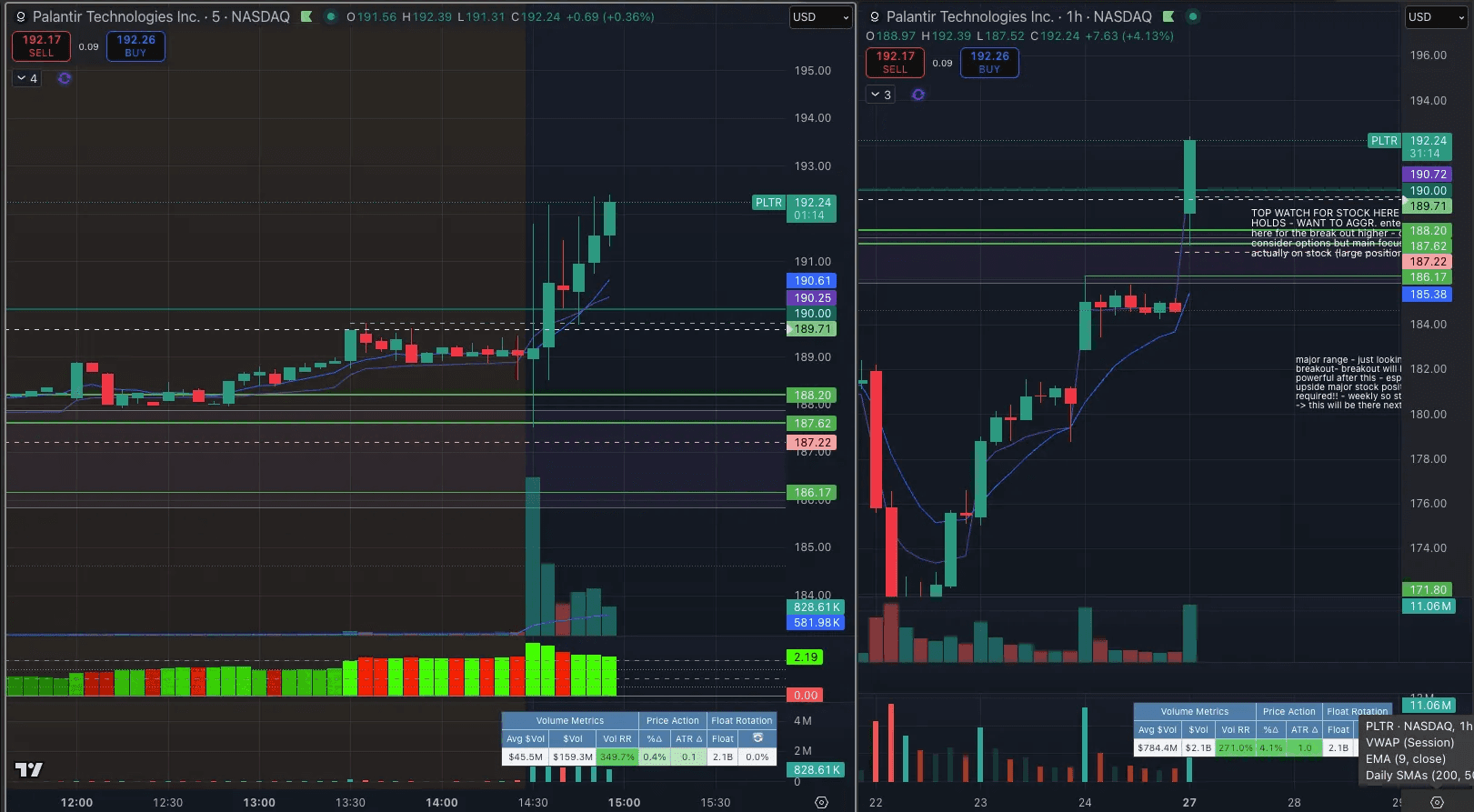

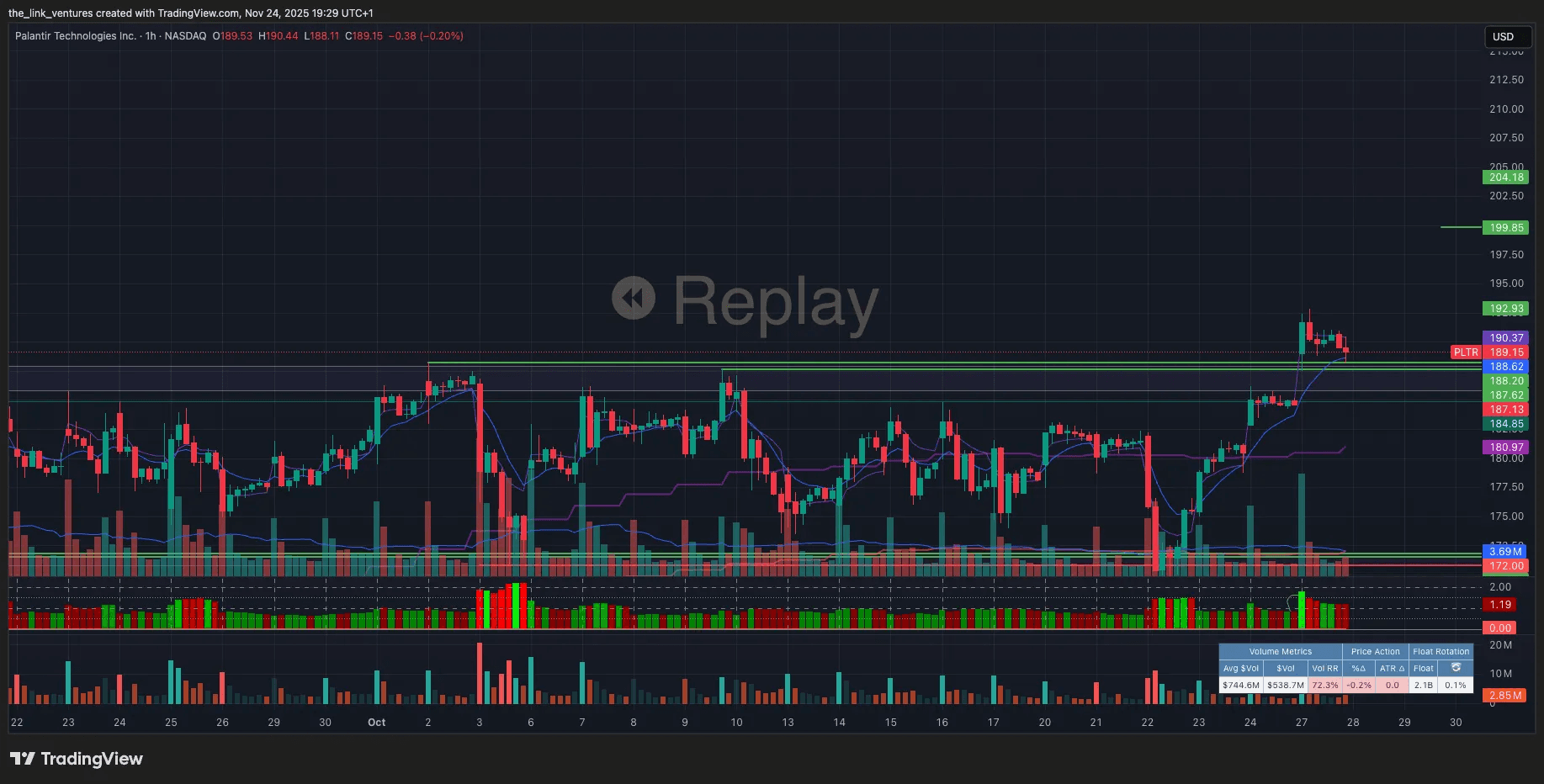

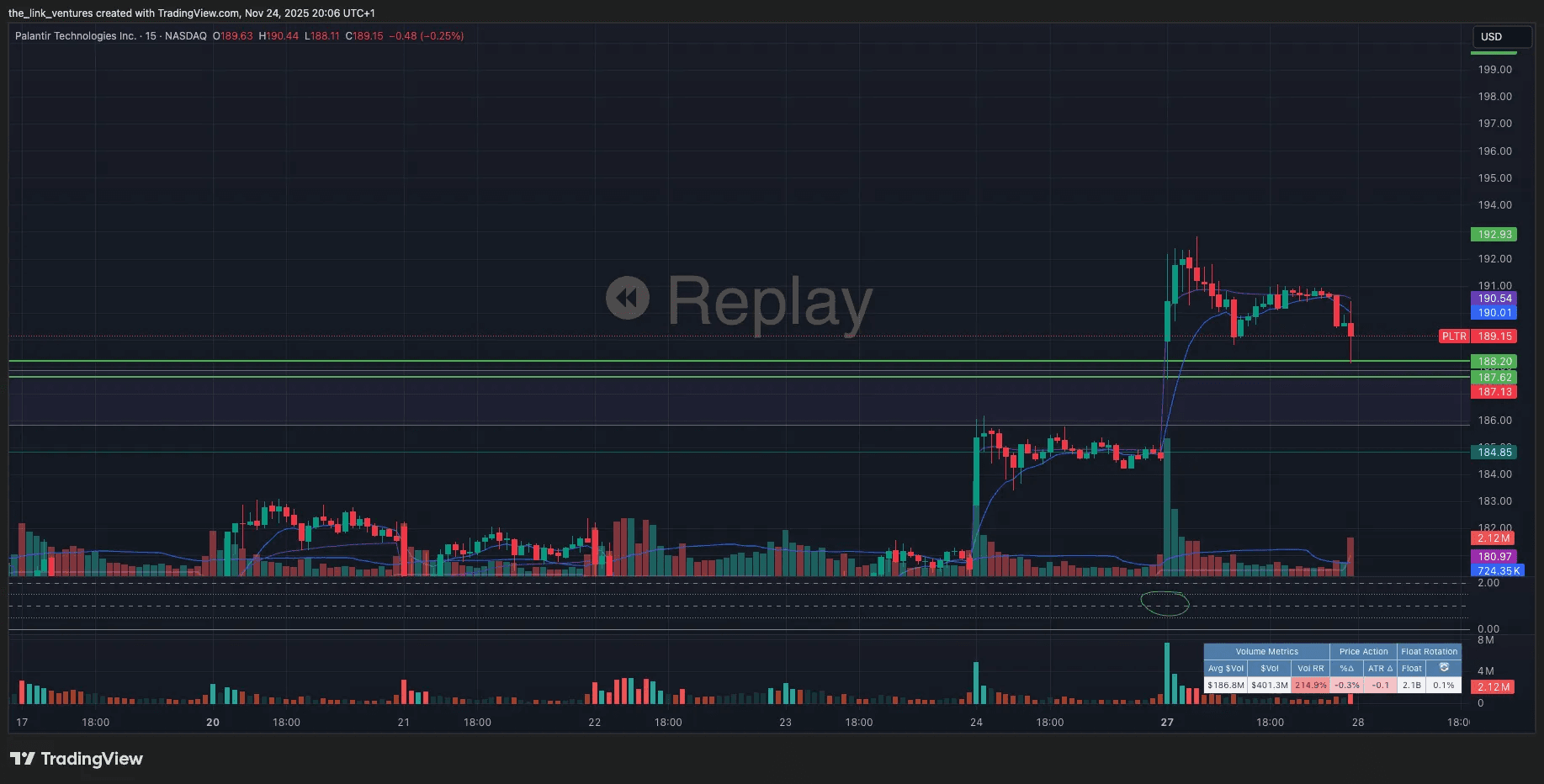

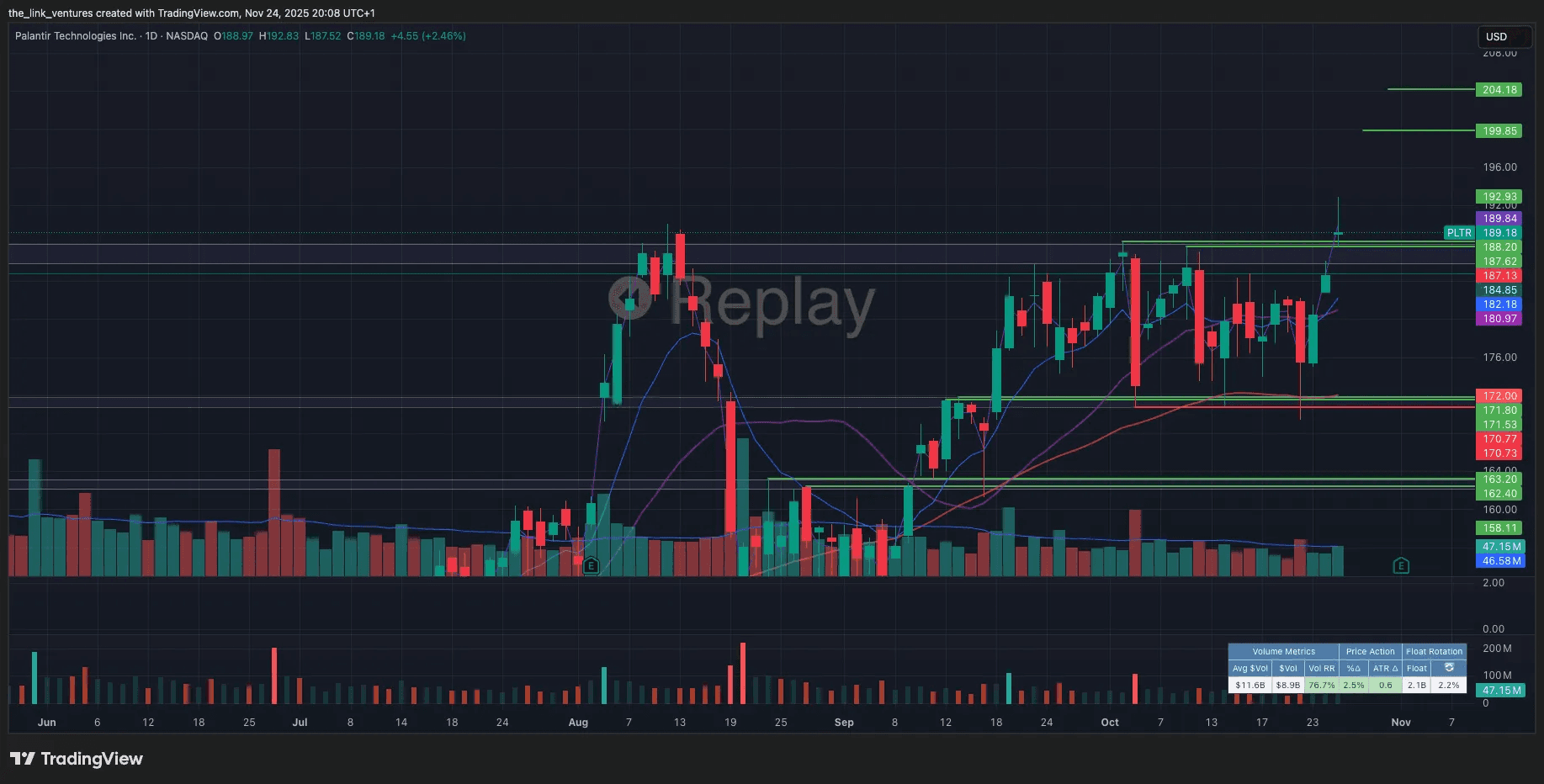

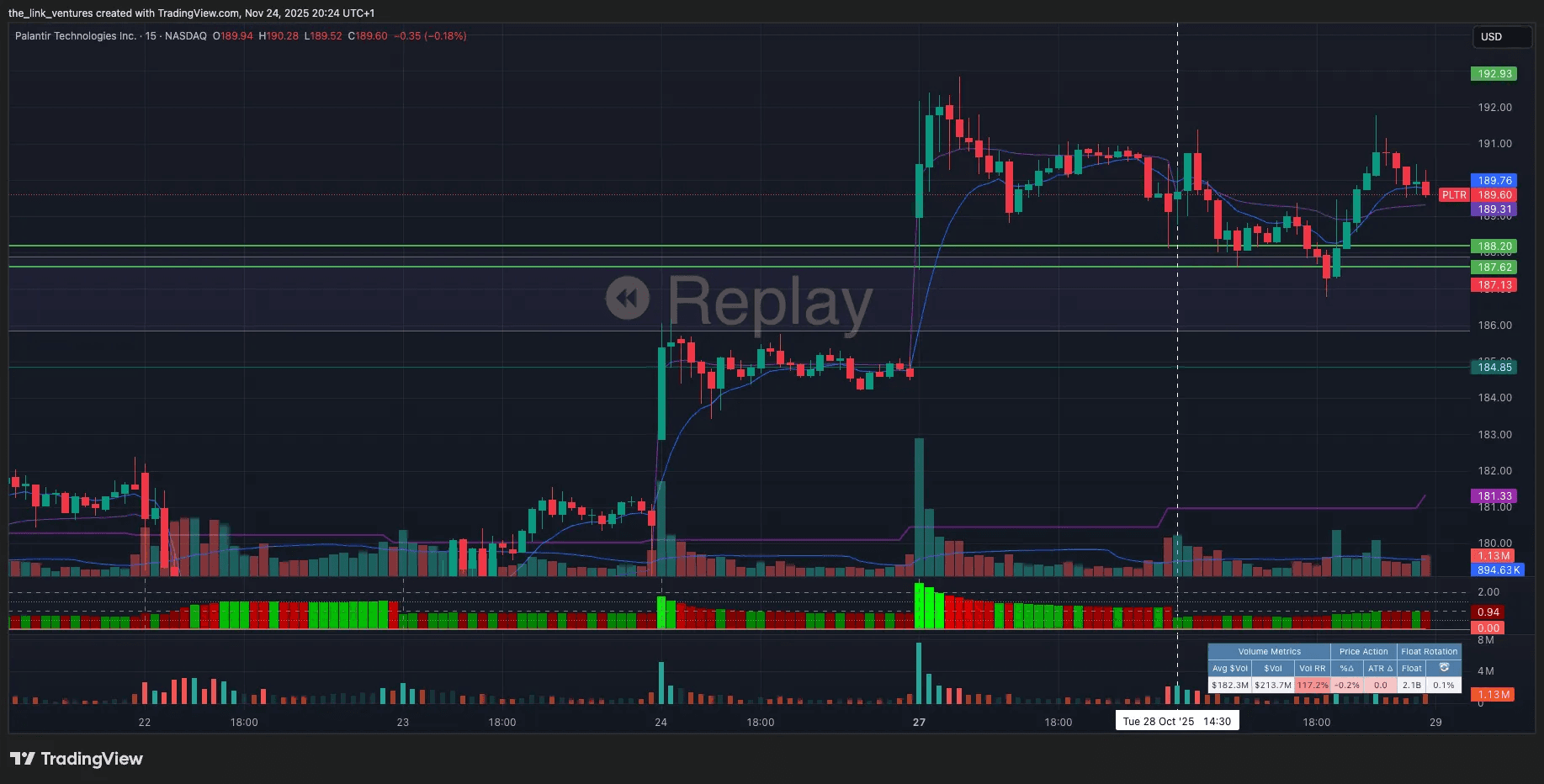

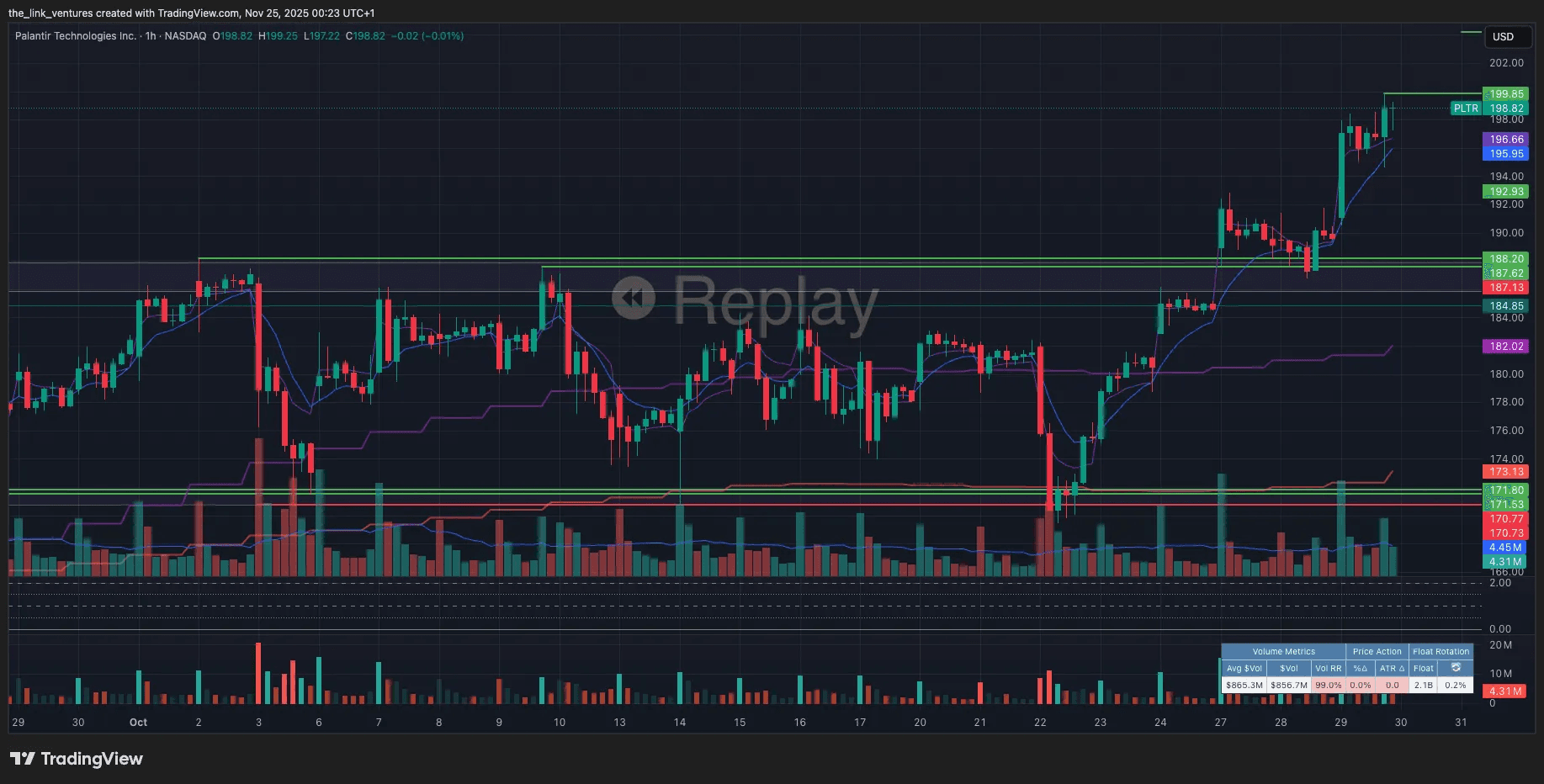

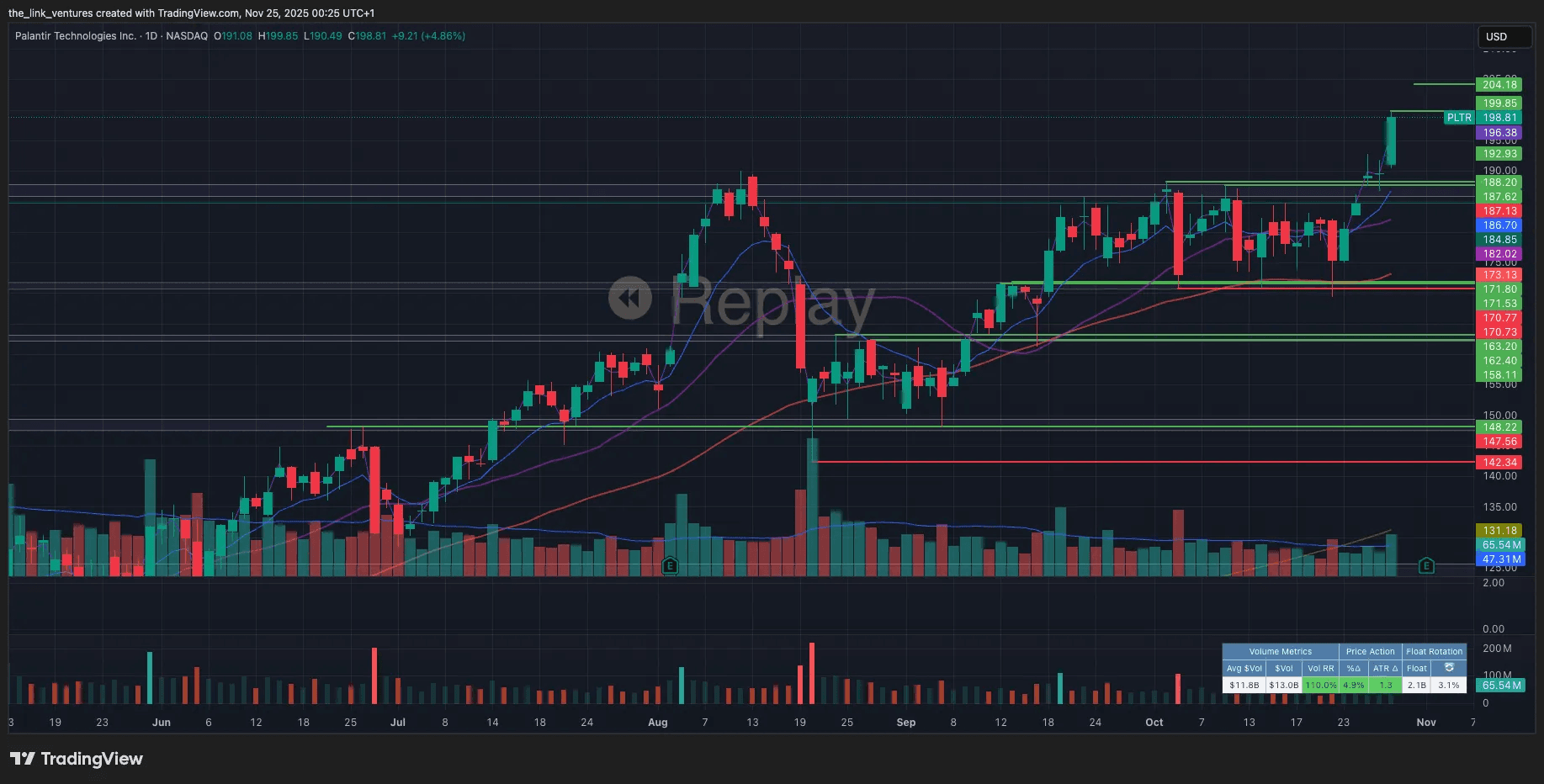

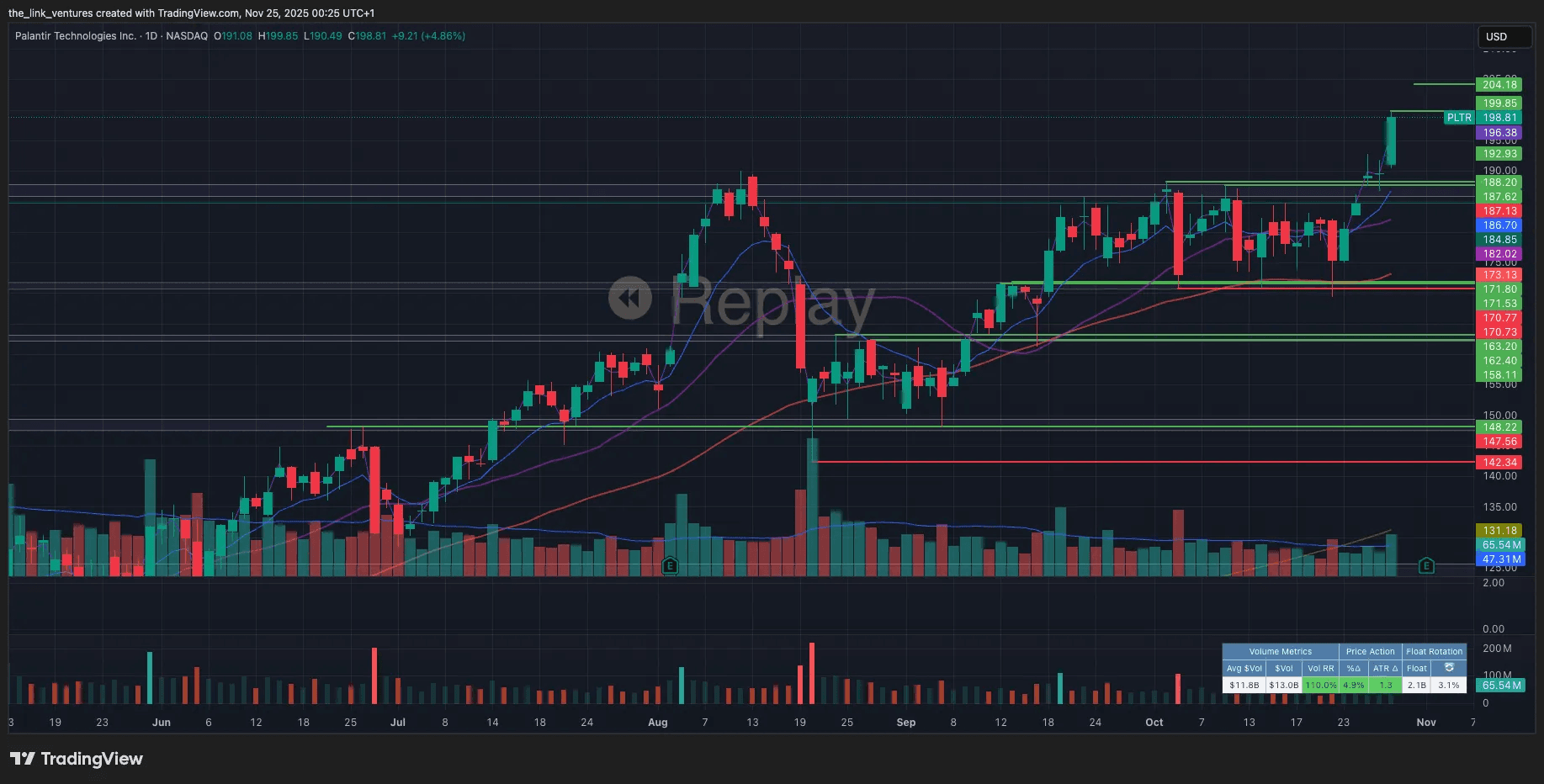

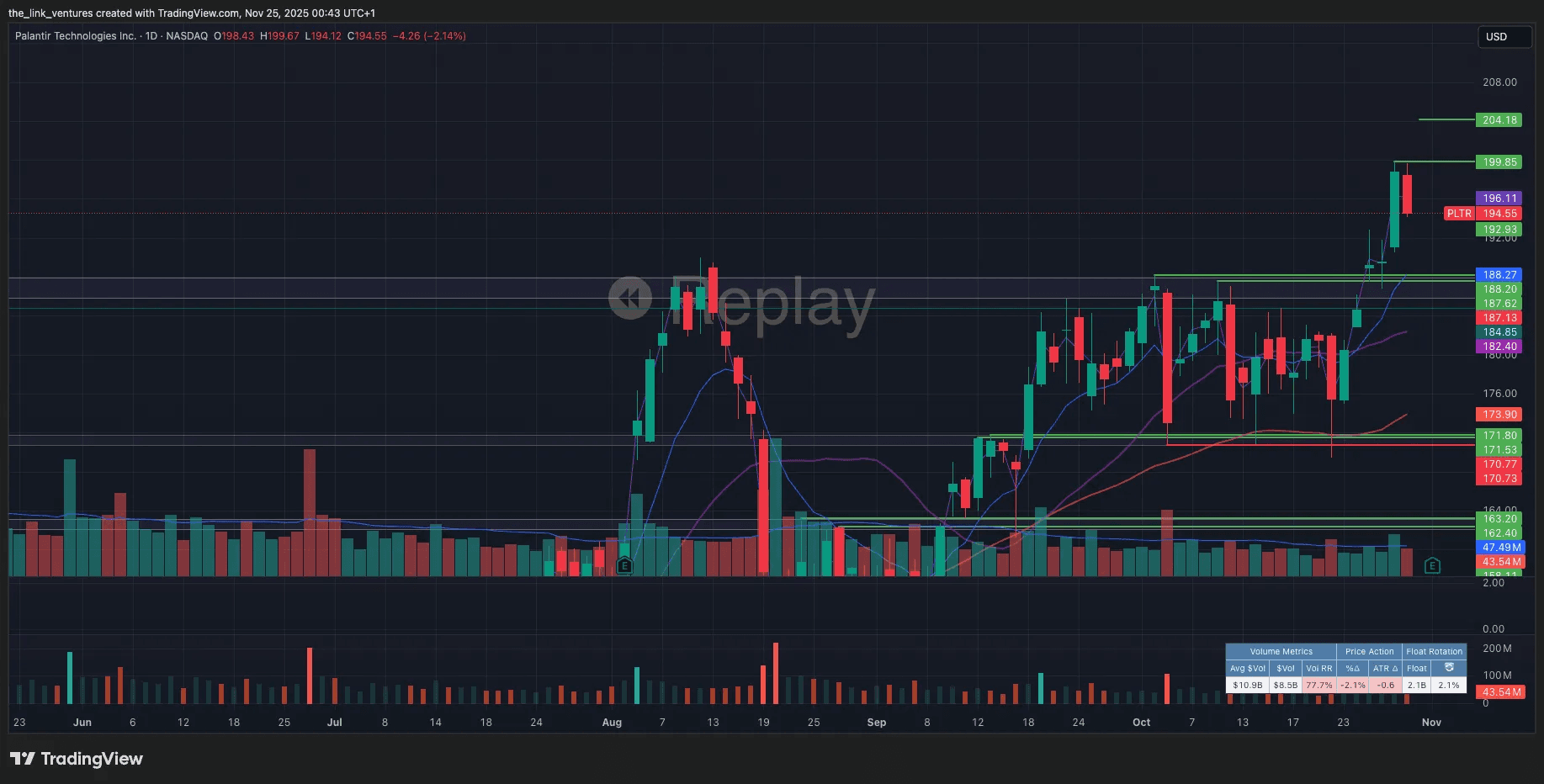

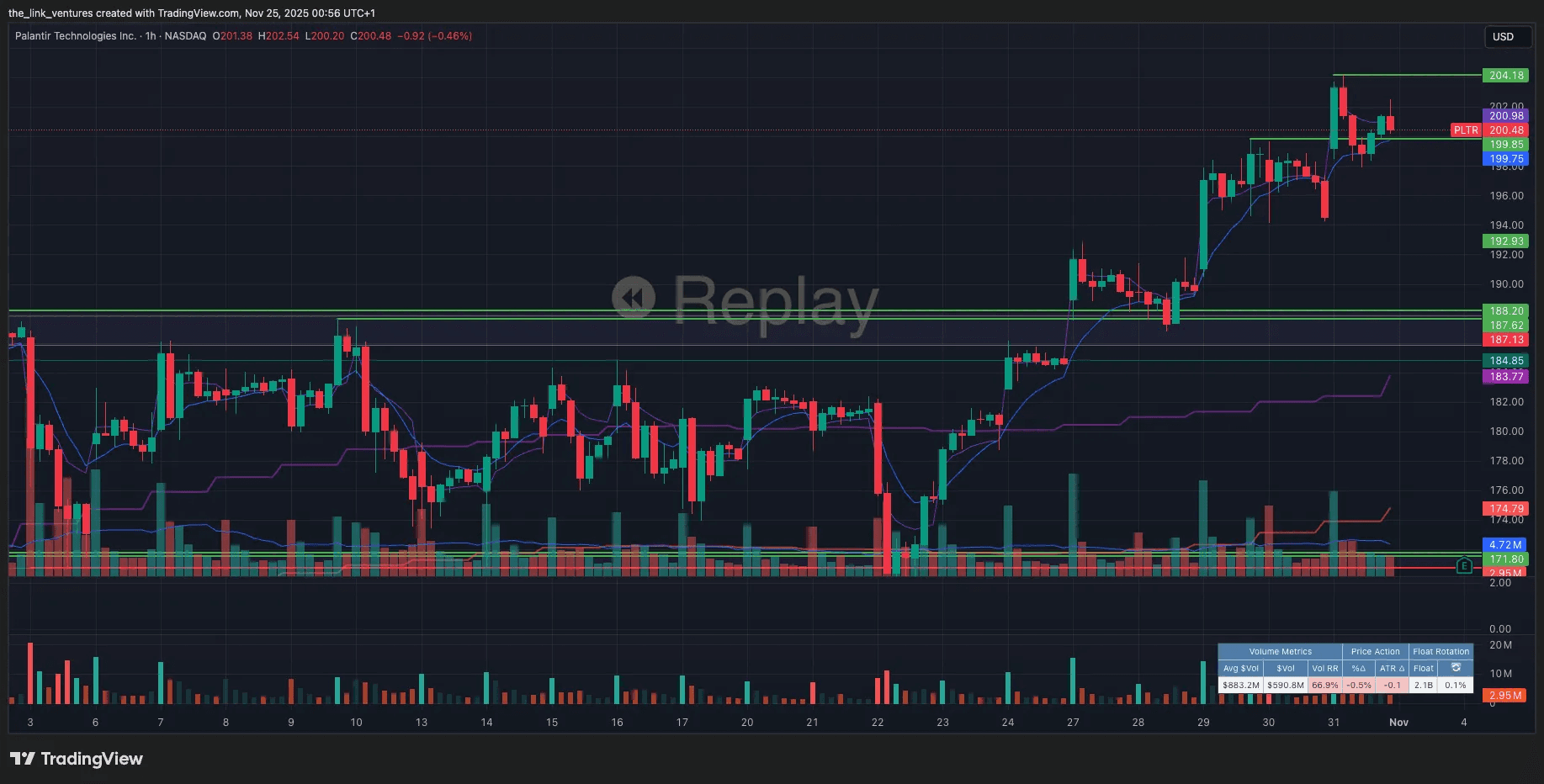

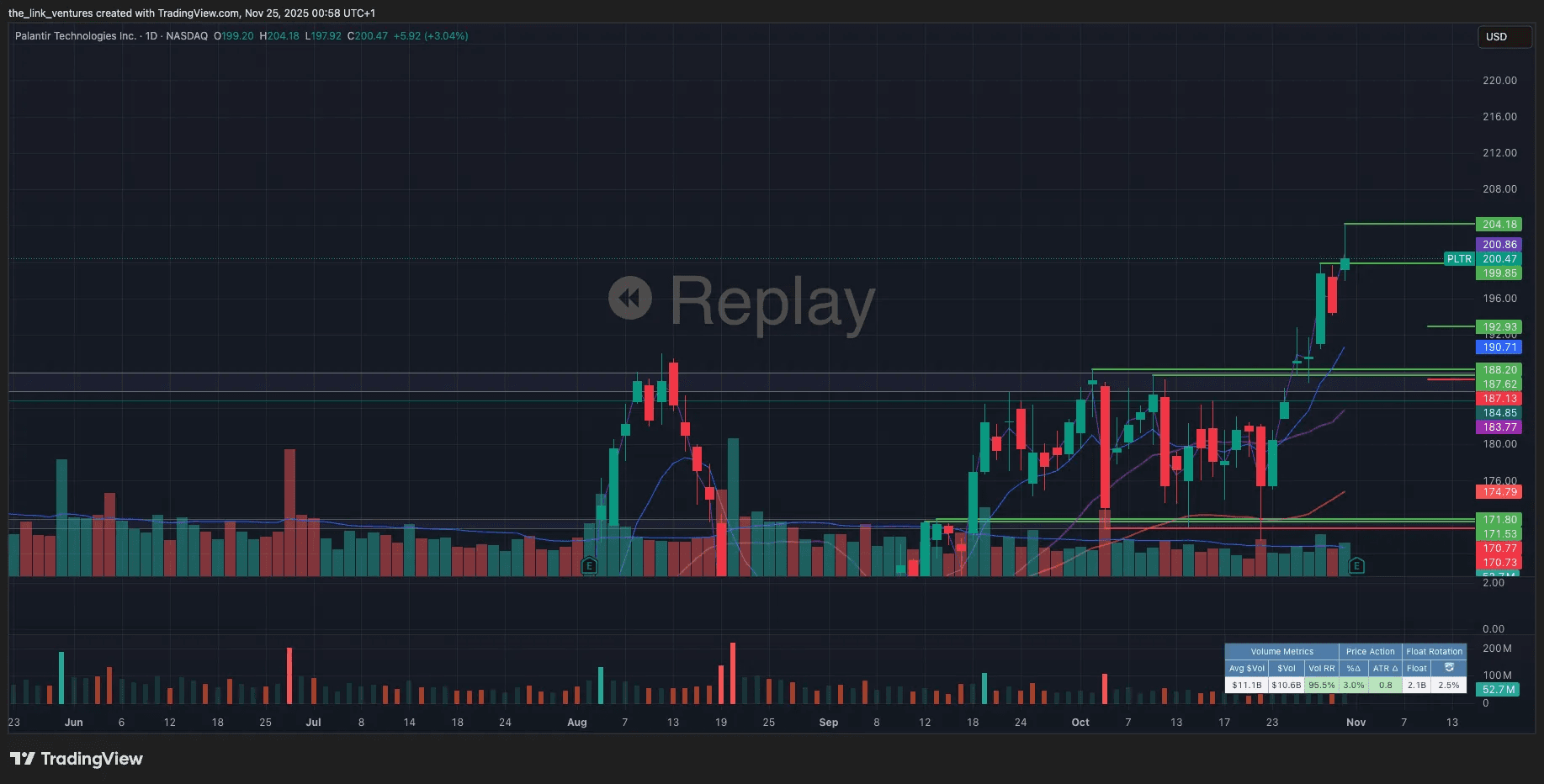

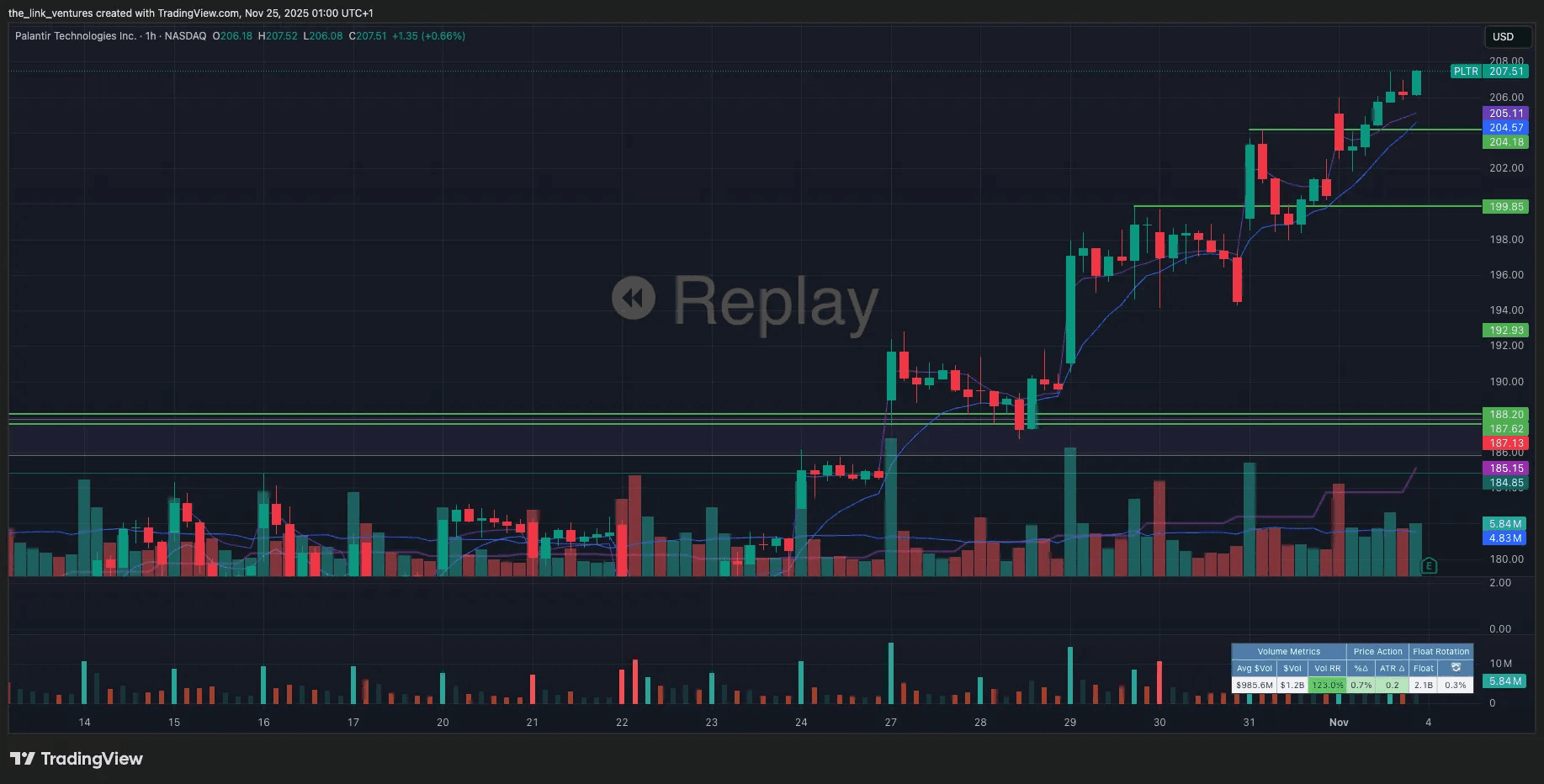

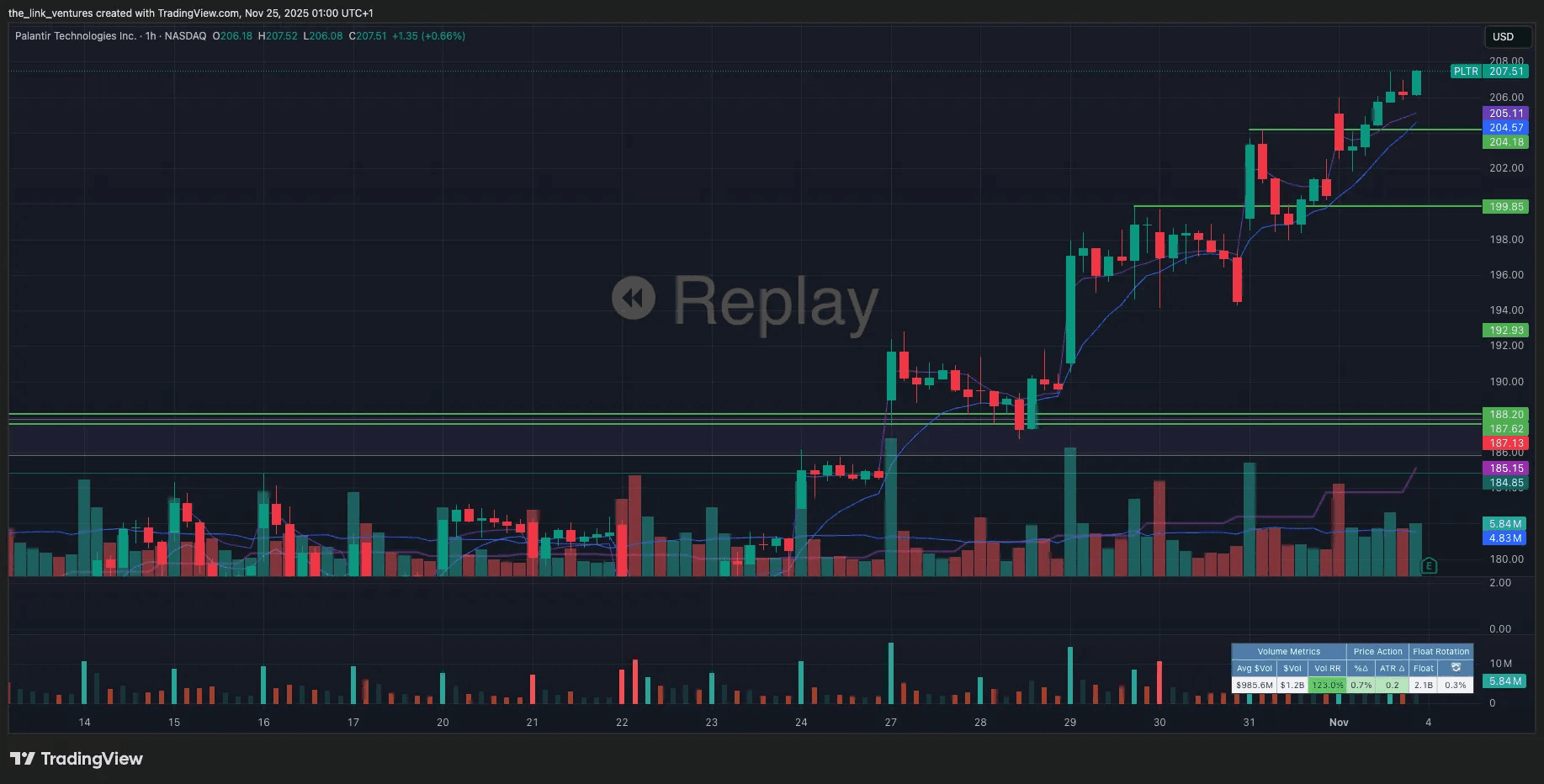

We have been in a daily and weekly consolidation range. We have previously seen attempts to break out of the range to either side but have never been able to get actual closes above or below the range extremes.

Location-wise, we are just below the previous ATH which was set prior to a very sharp and quick sell-off in August. Thus, a break to the upside can start to squeeze out a lot of shorts which are still holding on to their positions, as well as trigger new participants to enter the position.

Fundamentally, we are a week out from earnings, so we could see a run-up prior to the release pricing in expectations of stellar earnings. Generally, PLTR's valuation is astronomically high though, so anything other than an exceptional blow-out quarter (if even that) is likely not going to lead to upside post-ER. Because of that, there is a natural time cap on this long trade, as holding through earnings under these circumstances is not advisable.

What made me overall aware of the long trade here particularly are two things, which gave me the indication that we might actually see a sustainable breakout here.

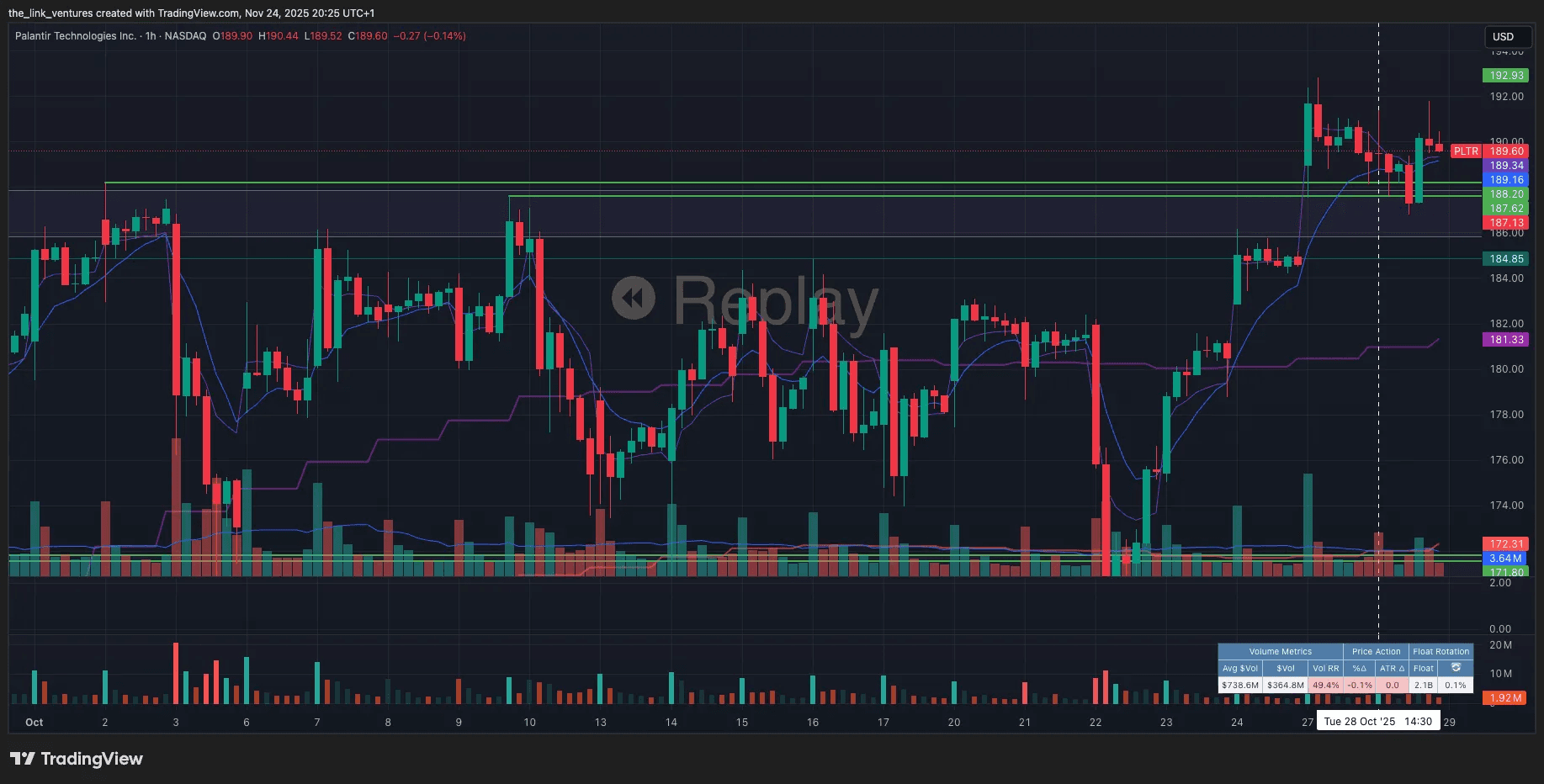

Firstly, in the previous week, we had seen an aggressive attempt to break out of the bottom of the range. The hourly closed below the range bottom after an aggressive move lower off the open, but got stuffed and saw no more FT below this.

This was the first time we actually closed outside of the range, so we can expect positions to be entered here.

We then get the quick recovery, as the shorts are starting to go underwater here. This sets up a strong short squeeze potential and overall Failed Breakout into Reversal.

Secondly, on the last day, we can see strong buying volume come in off the open, which can be due to larger market participants entering their positions pre-breakout higher.

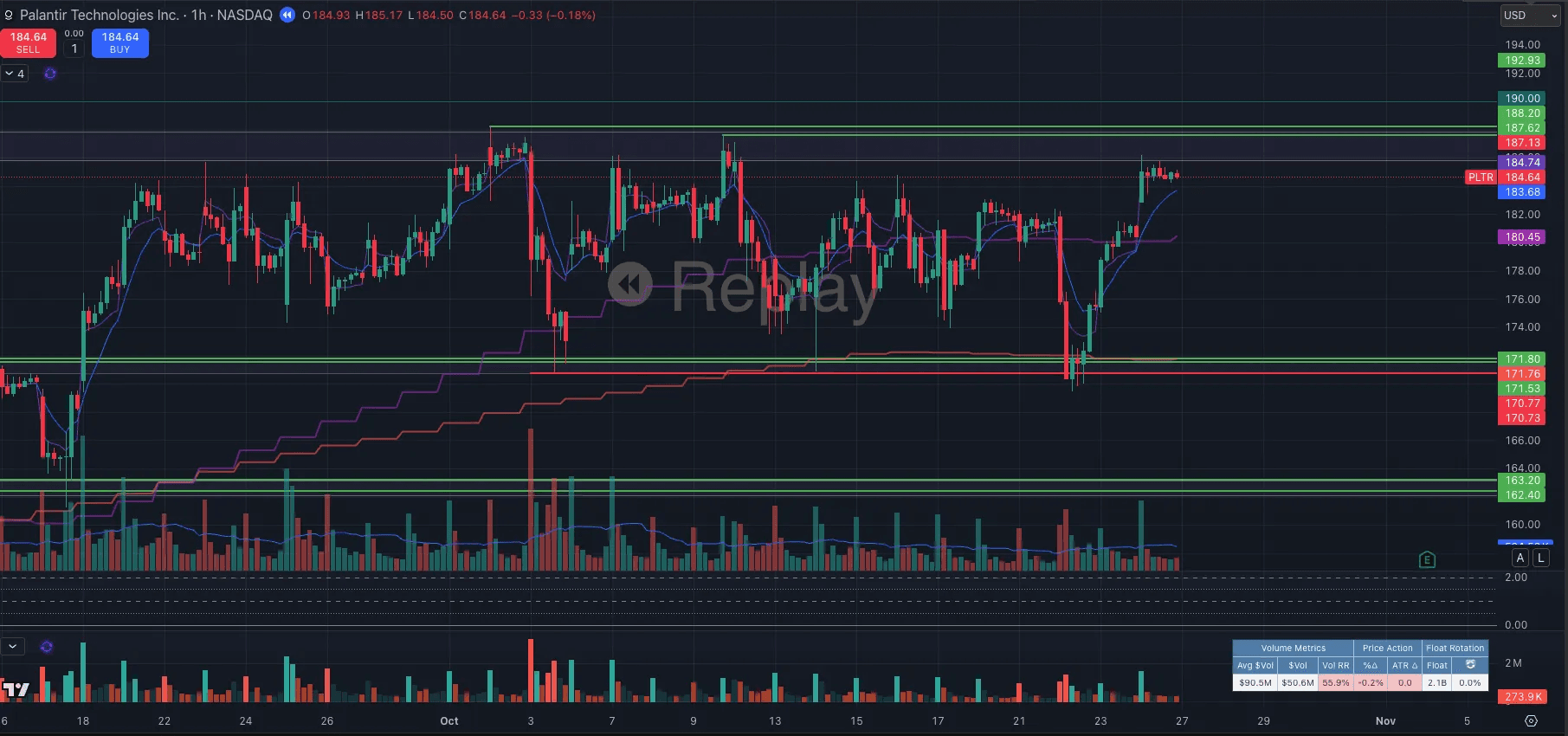

Having activated my interest, I was now looking for an entry opportunity into the move higher. As we have previously rejected the intraday breakout attempt, a gap out of range would allow us to clear this initial hurdle and get a sustained move higher. Thus, as we got exactly that on Monday, I am now looking to initiate the position…

Broader Market Context

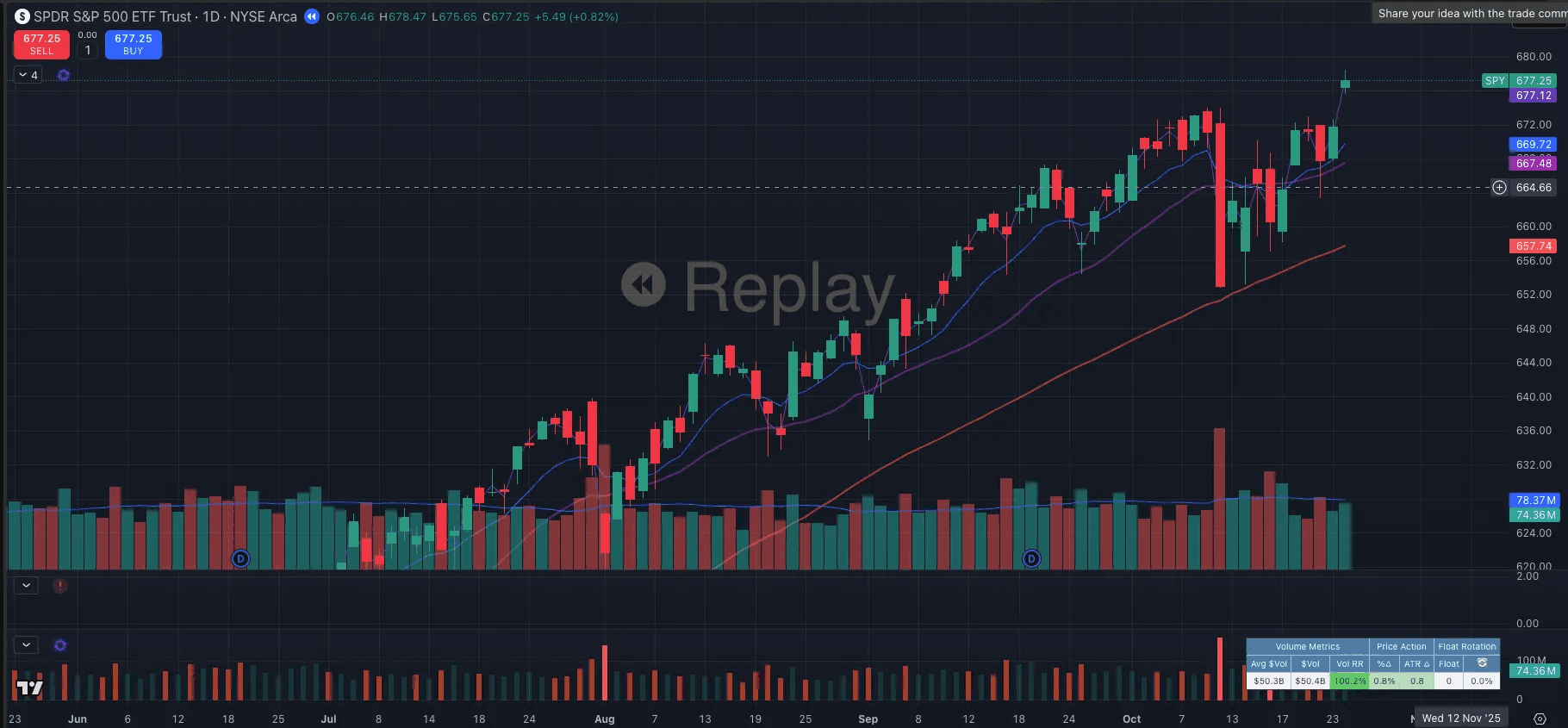

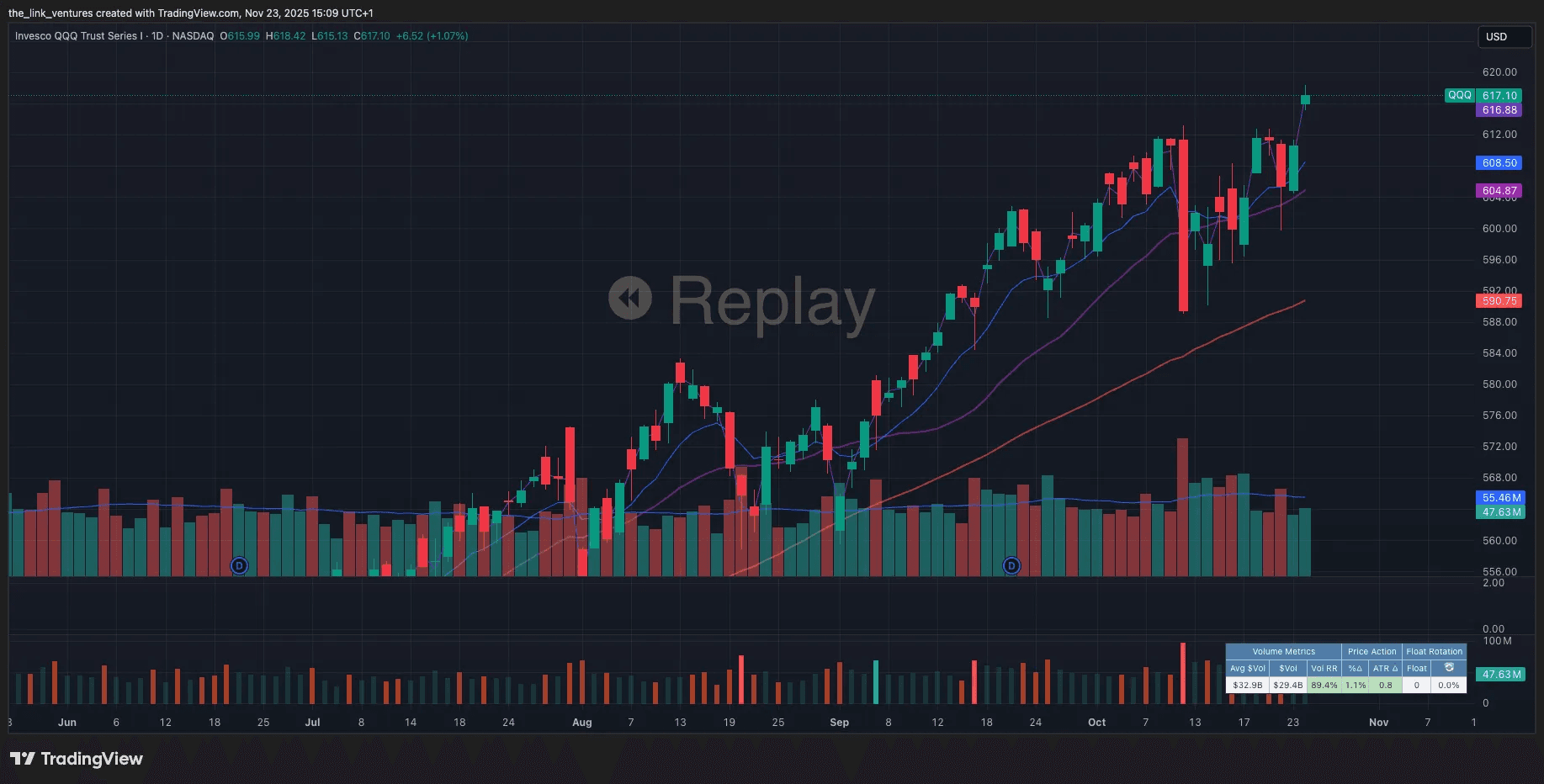

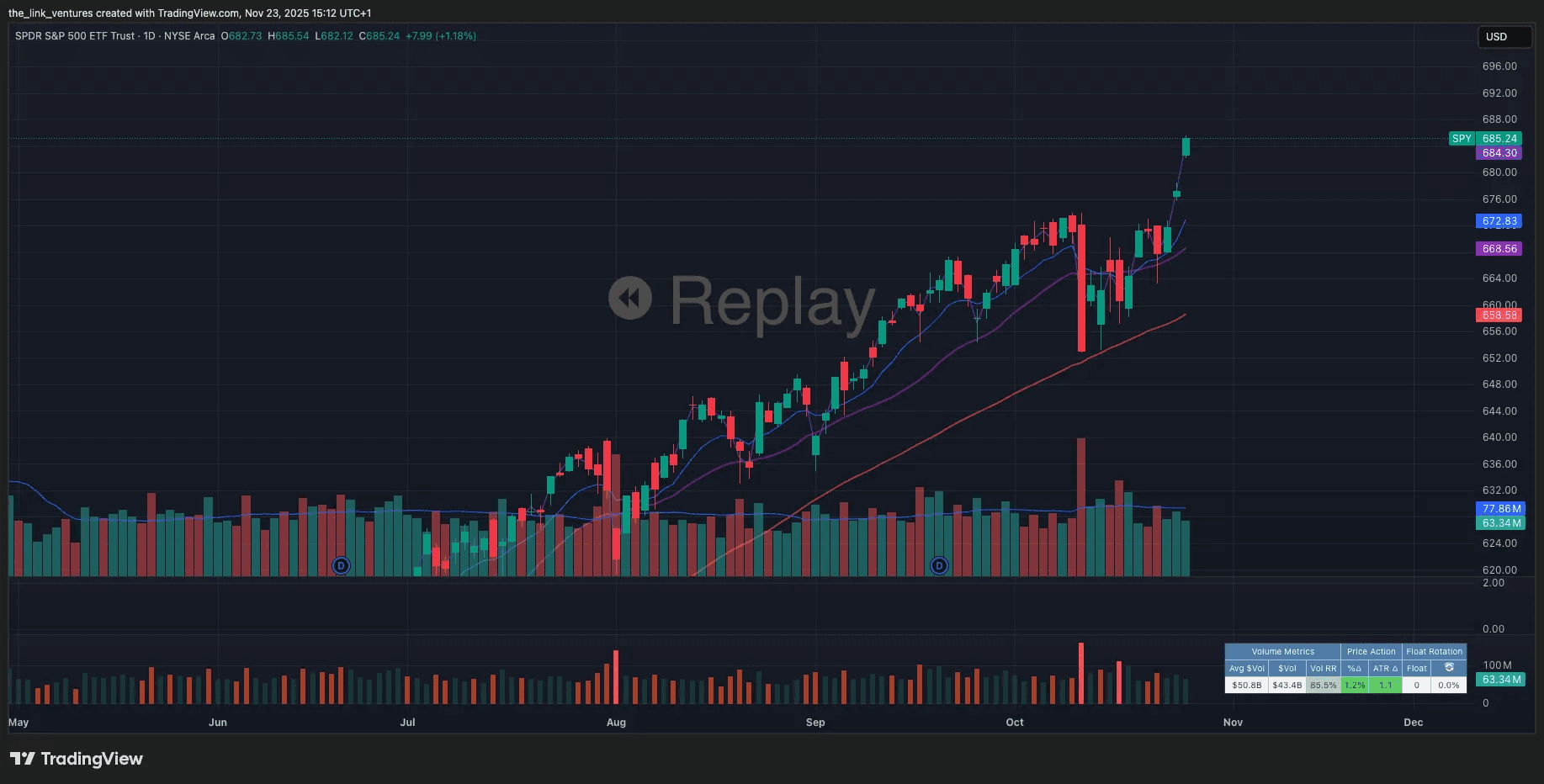

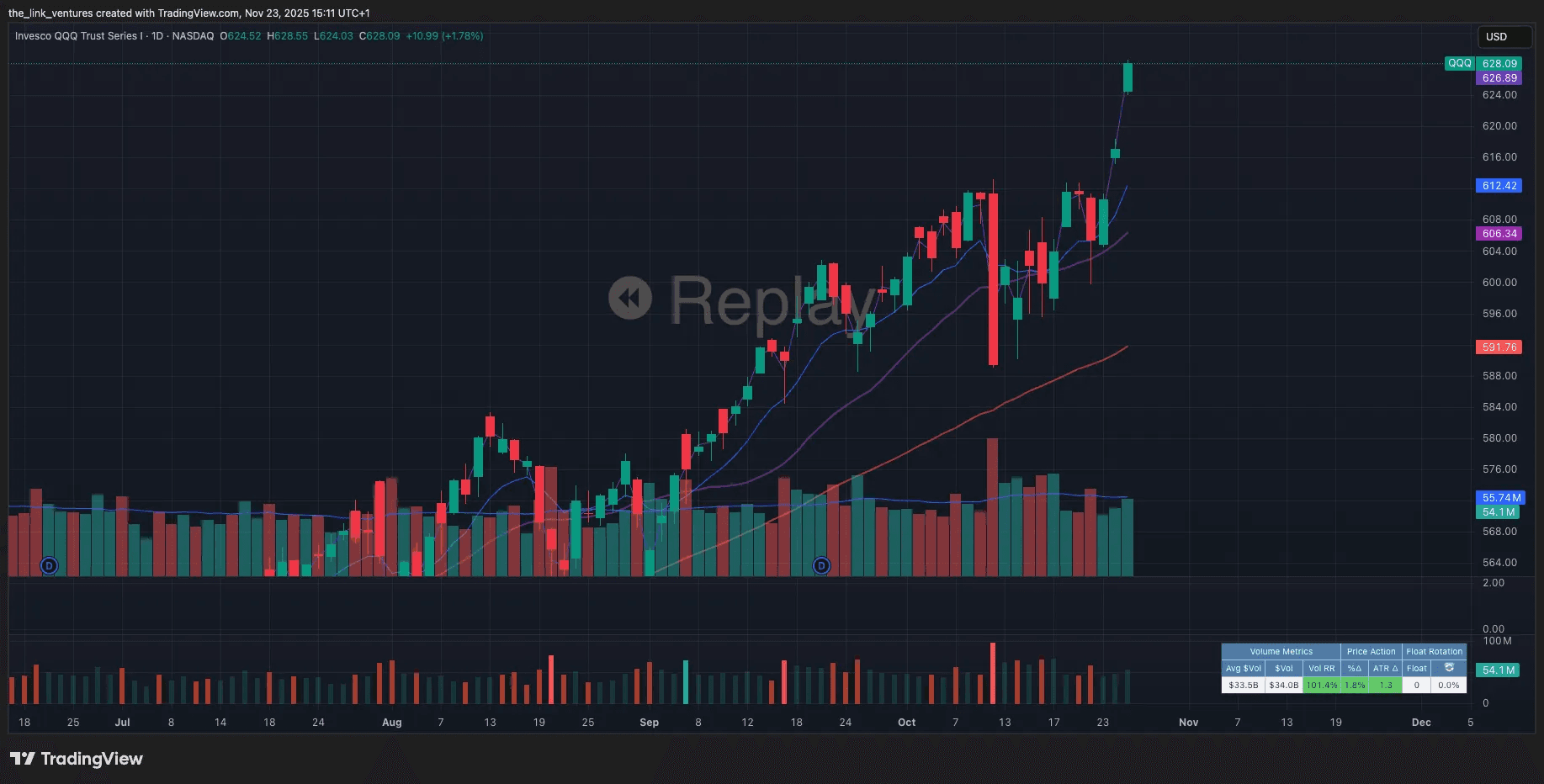

Meanwhile, looking at the overall market, we can see that SPY gapped into ATH on the Friday and was able to hold it during the day. This comes after a strong one-day sell-off into the daily moving average got no FT and we chopped higher again, as we typically have for months now.

Similarly, the QQQ also gapped into ATH and held it.

The market clearly remains long here which should allow for favourable beta on the PLTR trade. On the following Monday morning, we actually gap up again on the back of political news over the weekend. This set up a potential market overextension which could have an impact on the PLTR trade if the market is not able to hold higher. Thus, monitoring the broader market and main contributors to the indices was crucial.

Trade Entry

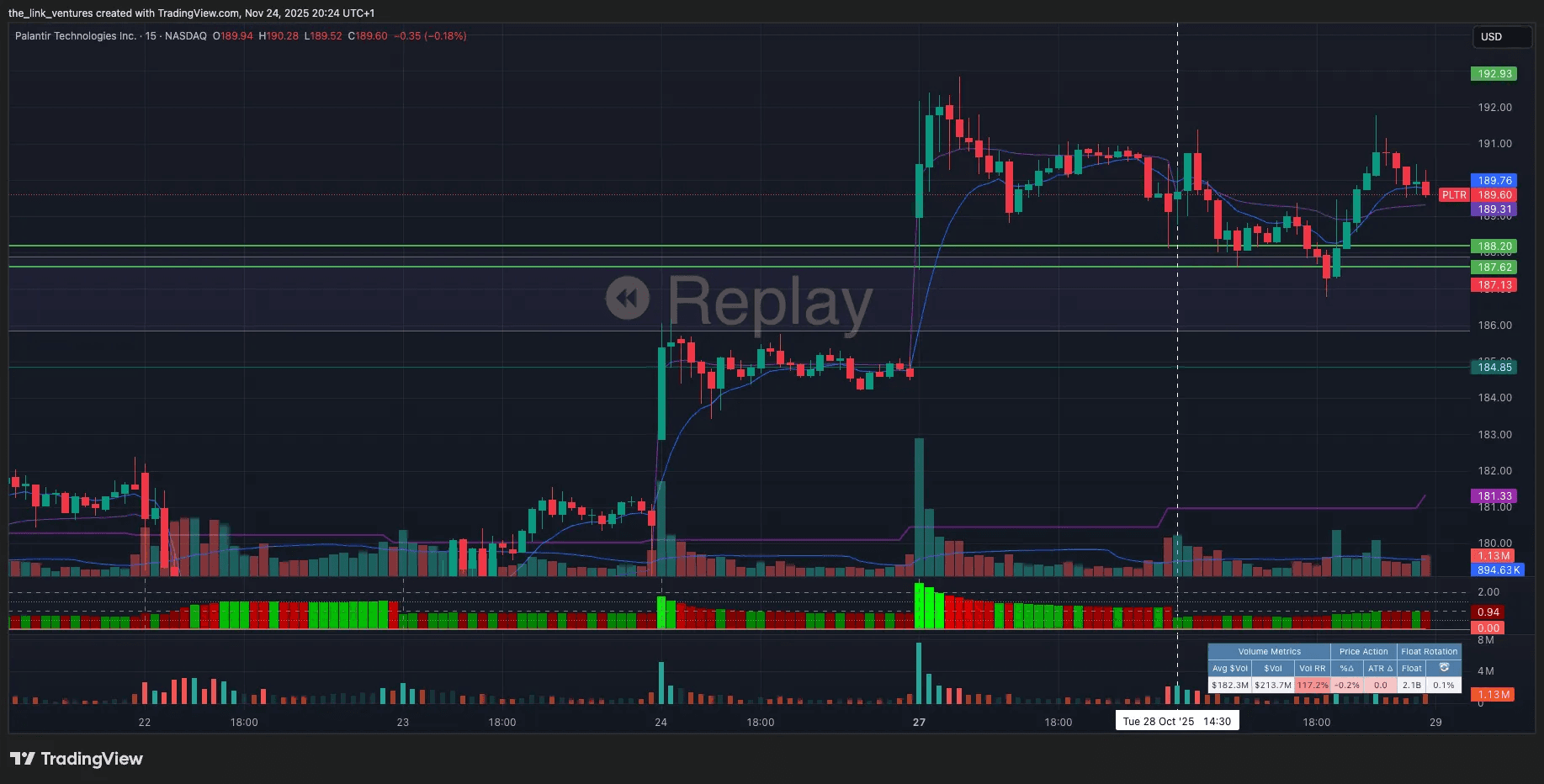

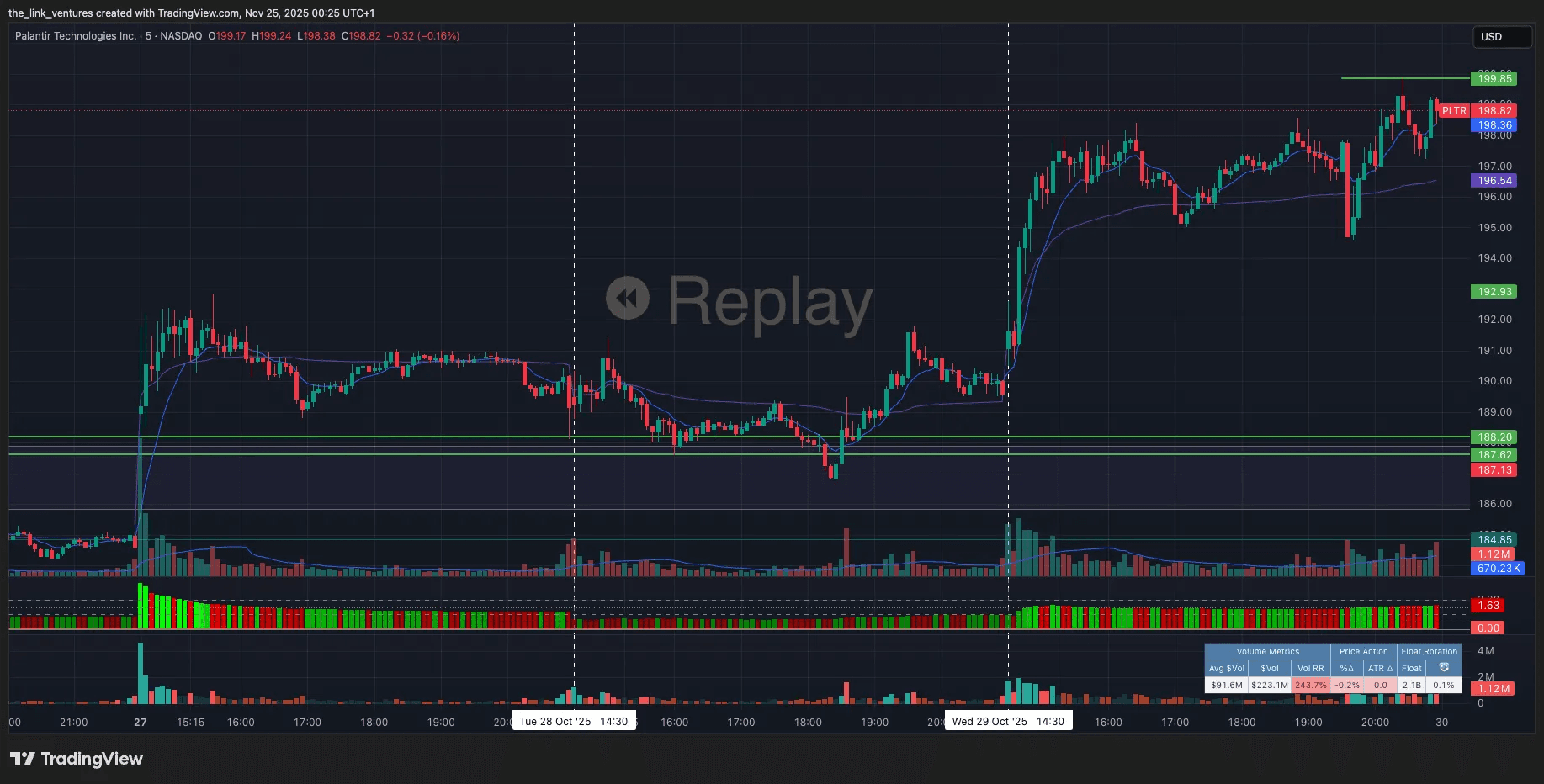

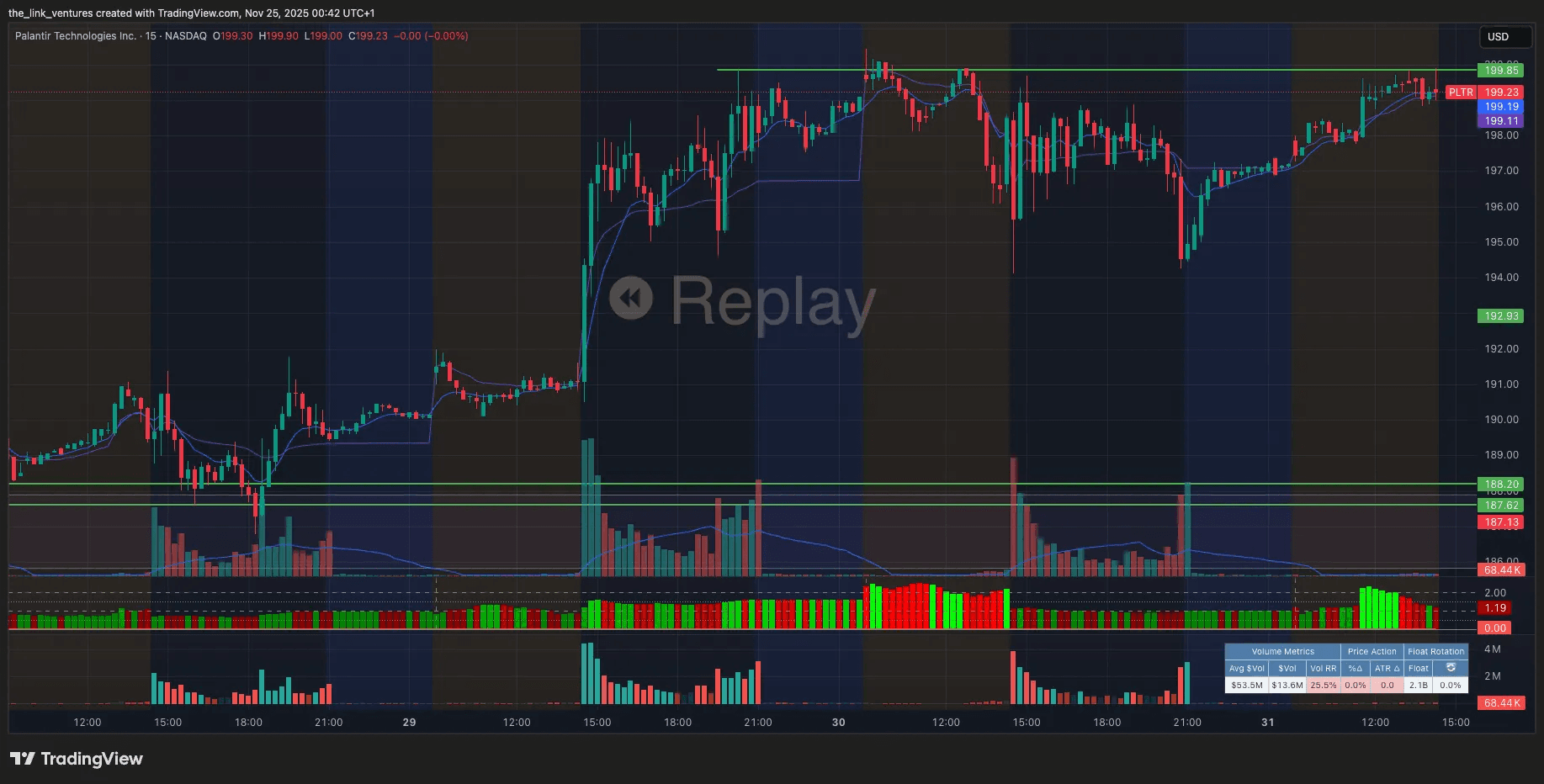

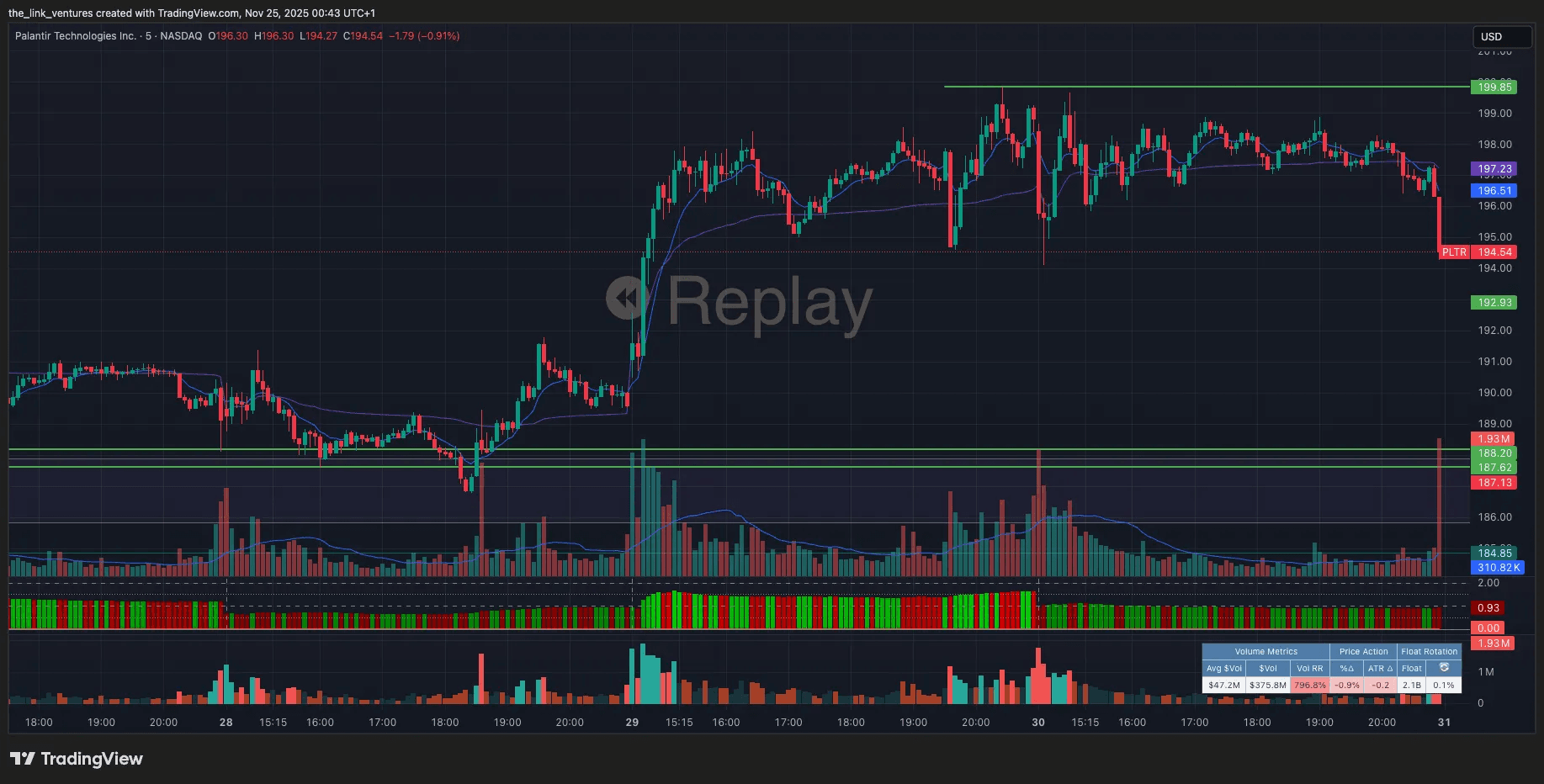

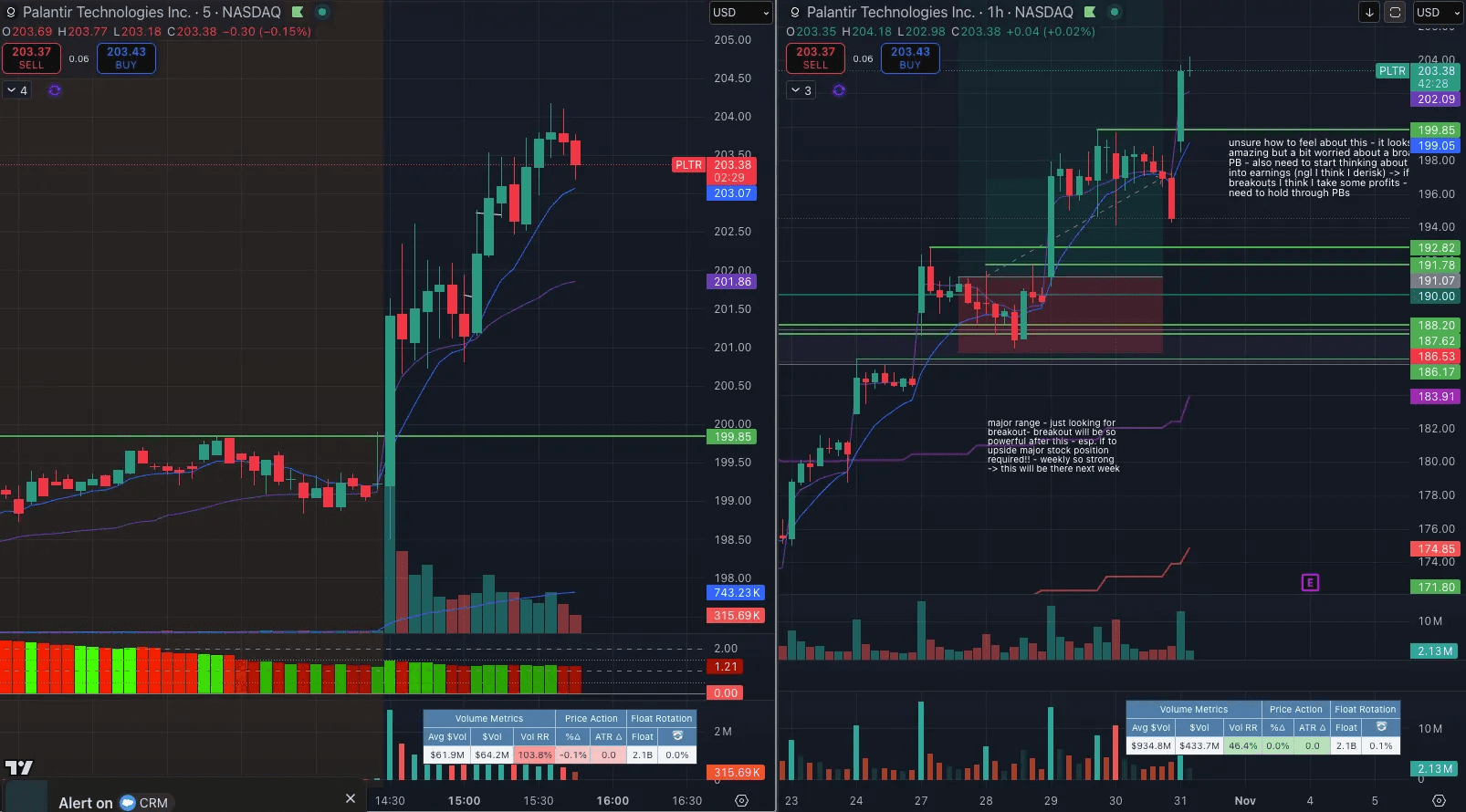

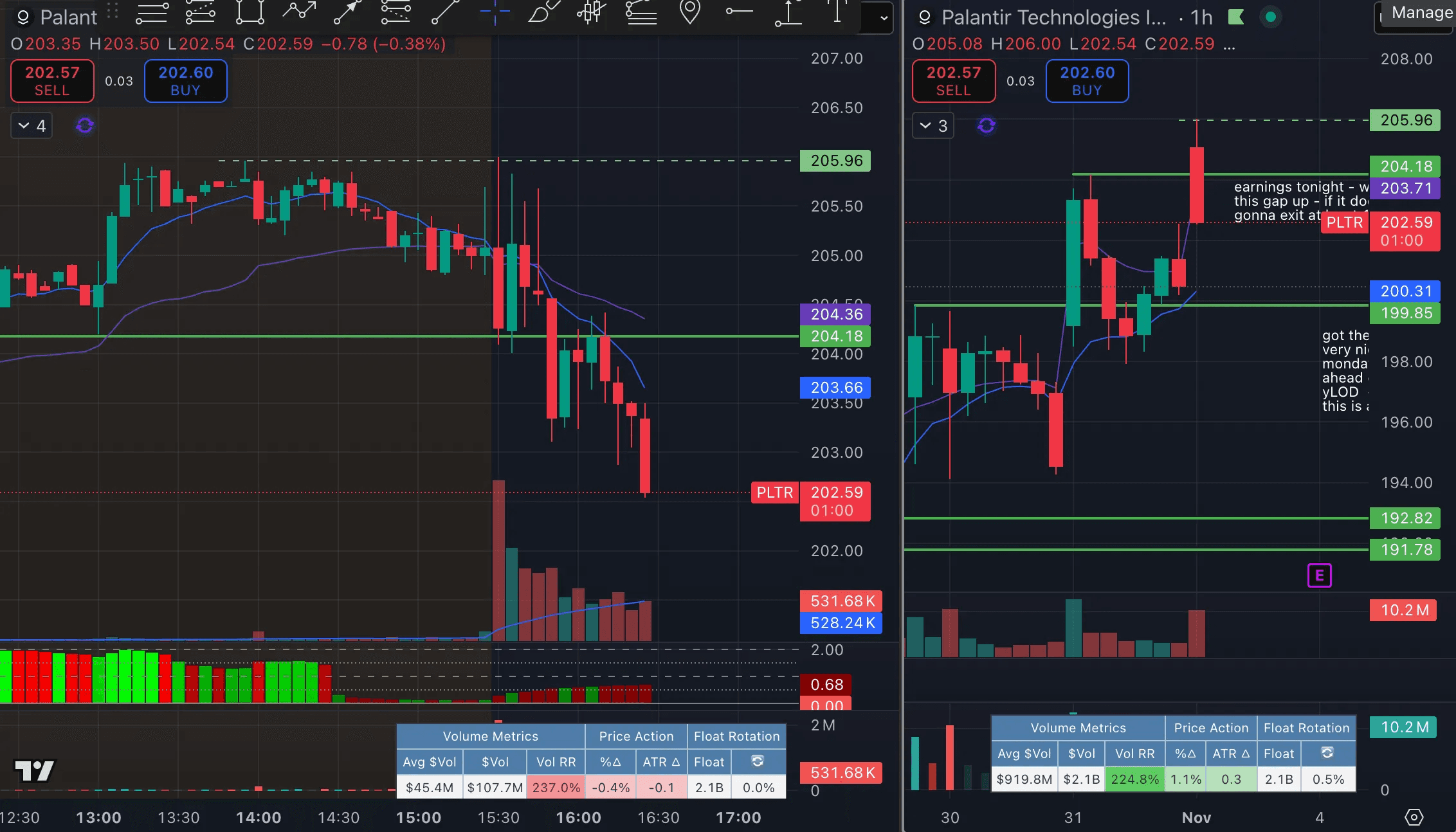

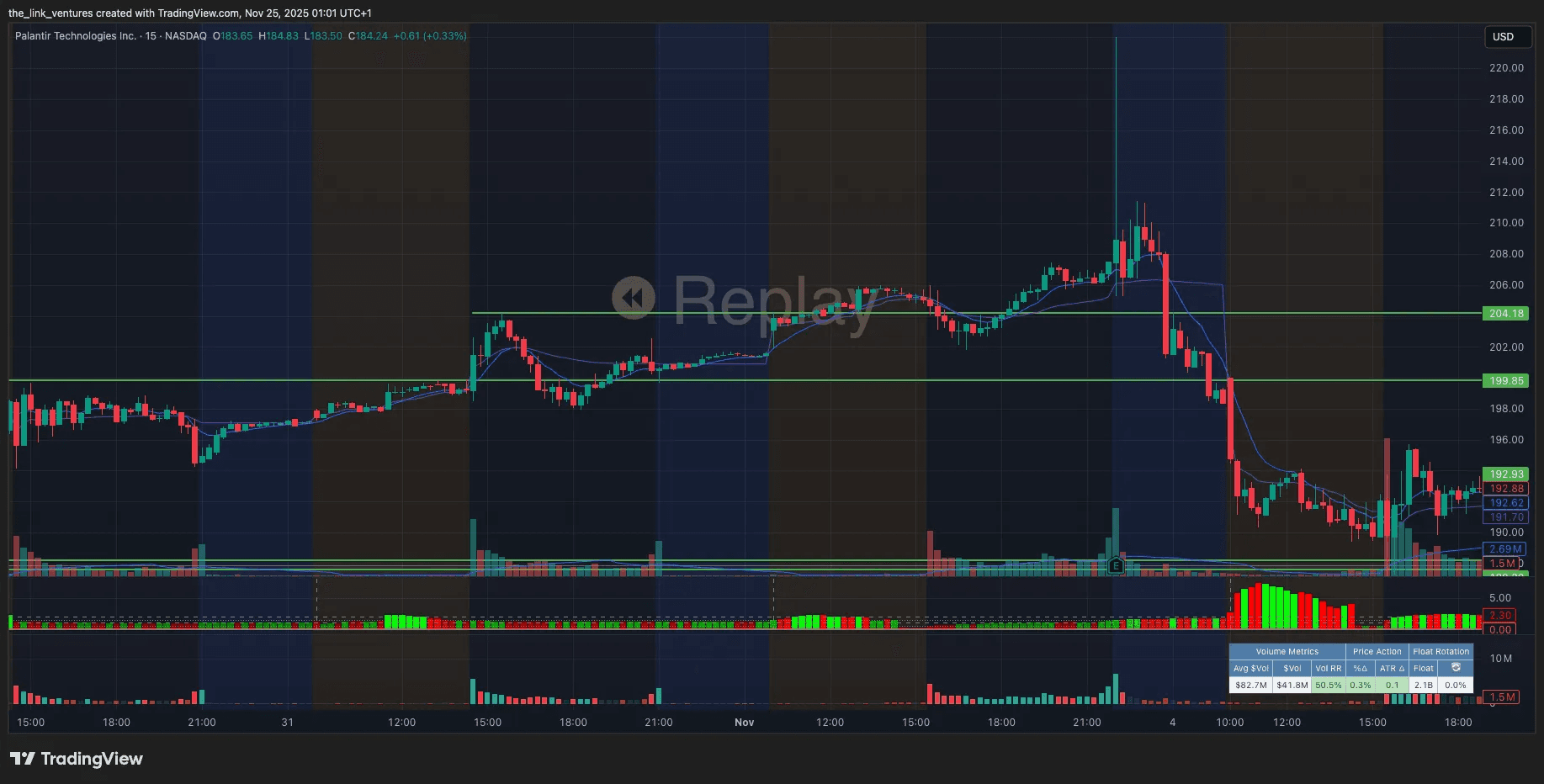

We gap up above the range on the open.

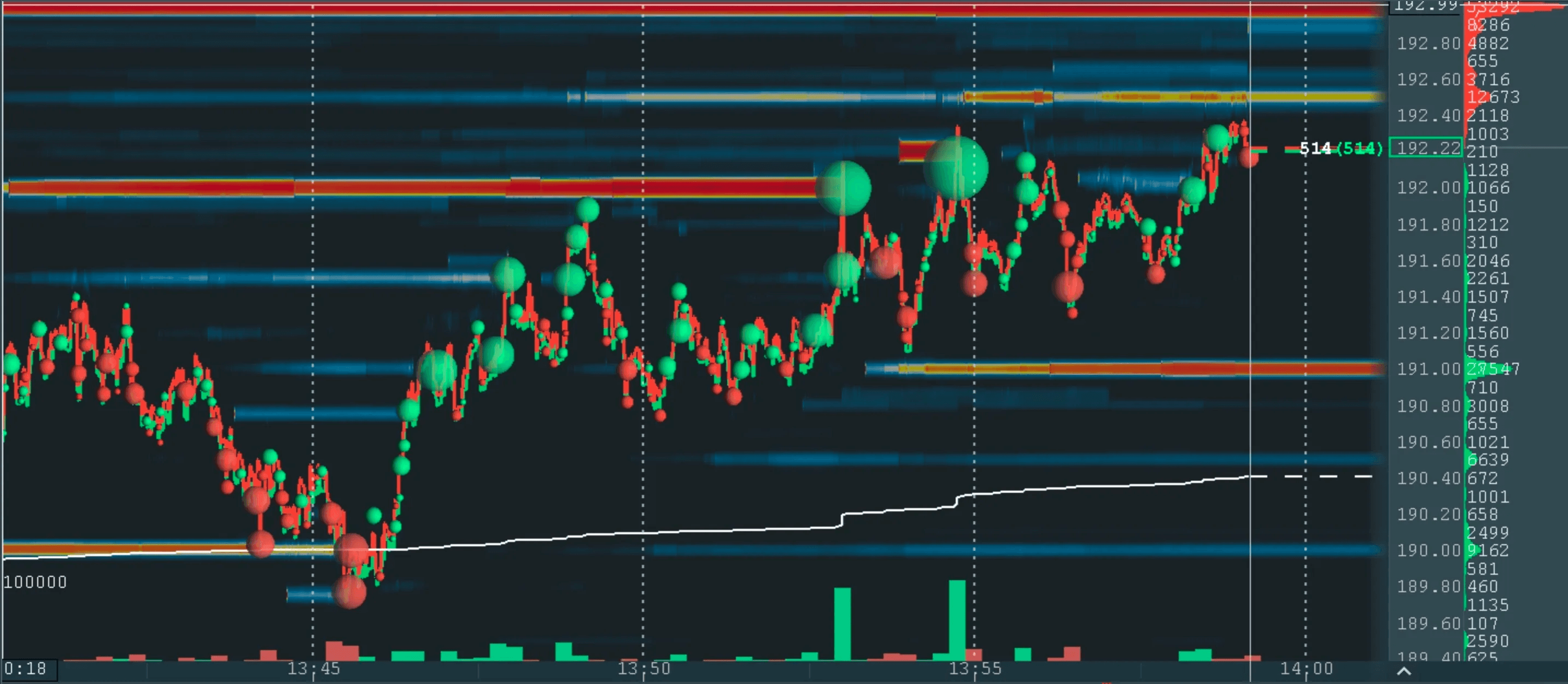

We then see a wick hold off the 5M off the open to reject the initial gap fade. We then are able to break above the overnight high as well as previous ATH.

On the 5M we are now building out a quick 5M HL which gives us the confidence to start to put on the first position here for the aggressive push higher. Given the longer-term swing idea here, we want to take smart options which allow us to hold onto the position to not be exposed to theta decay or falling volatility, or stick to equity in this case which will allow us to play this from a purely directional angle.

Buying volume is strong and RVOL is clearly elevated, showing that the stock is in-play and market participants are willing to trade this, which is needed to hold this gap out of range.

On the heatmap, we can see asks trying to get filled, but there is a clear interest higher as the pullbacks post-ask fills are weak and we get supporting bids coming in. This is a typical picture of aggressive buyers trying to push the stock higher with no sustainable selling rejecting it. Not entering the position here because of these asks getting filled would be a fatal mistake, as they are clearly not as strong, nor are they reloading a lot.

In terms of target, we are looking for an extension higher of the size of the daily range for the first take profit. Given our concern with earnings next week, this might have to be cut short as prices are developing.

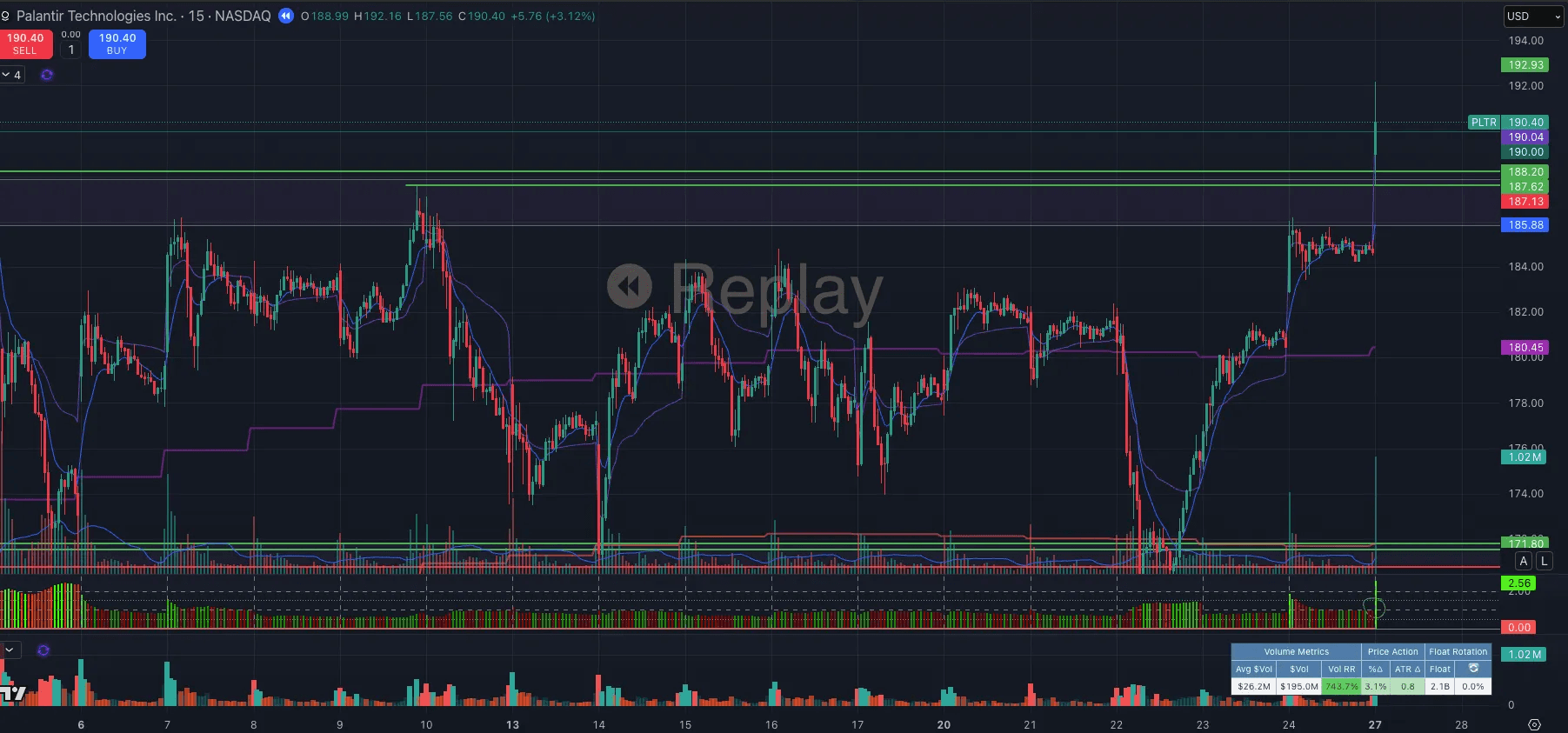

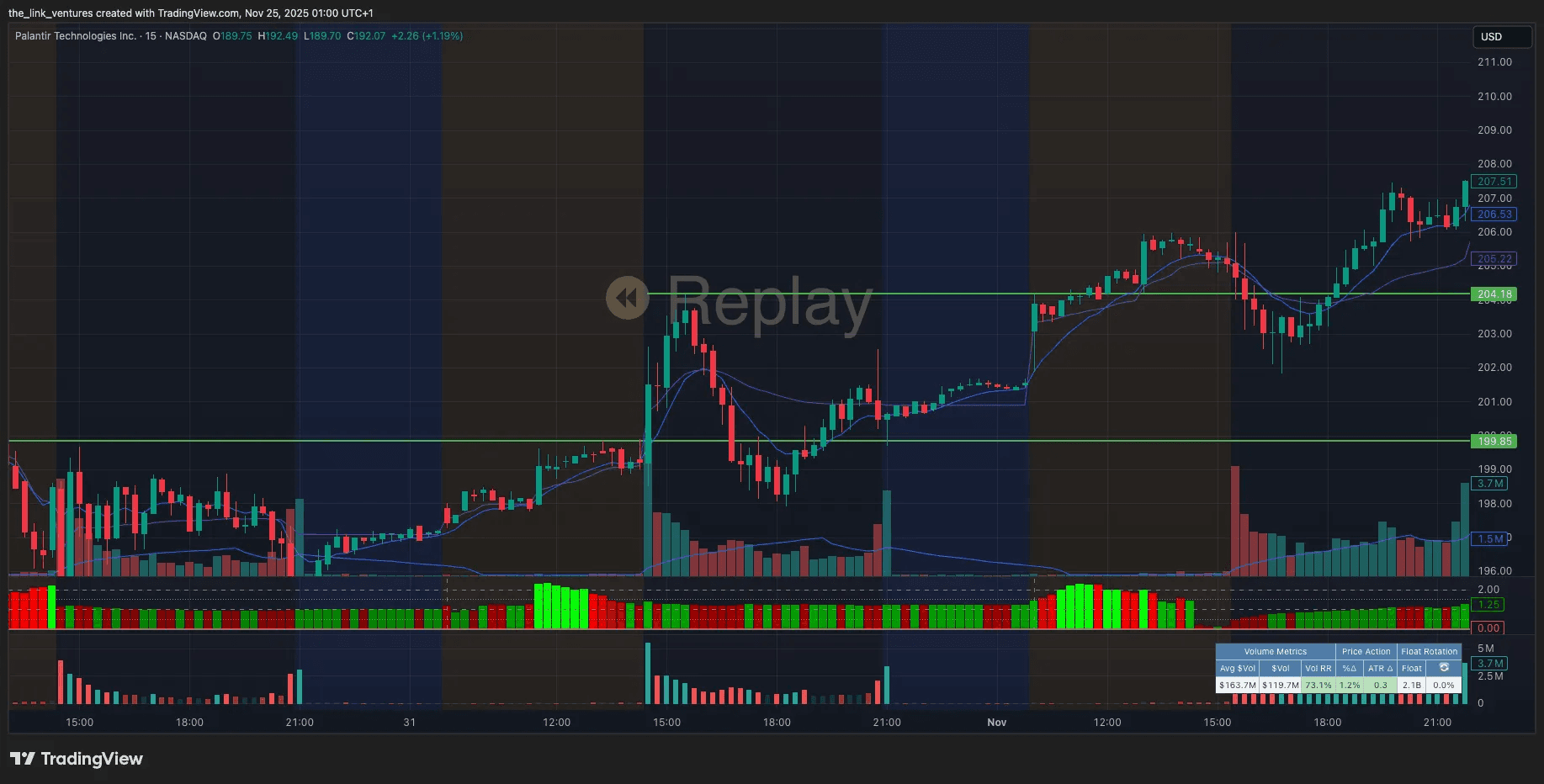

1st Day

Post-entry, we see that prices started to pull back and start to consolidate sideways for the rest of the day.

This did not pose a threat to our trade as we held above the range highs. This shows acceptance of higher prices, allows more larger participants to enter and creates a solid base for a push higher.

The daily candle closed with a large upper wick with potential to fail back inside. This is not an amazing close and requires careful monitoring in the coming days. Currently, the trade is not performing as expected but no state has been reached at which we would have to look to exit.

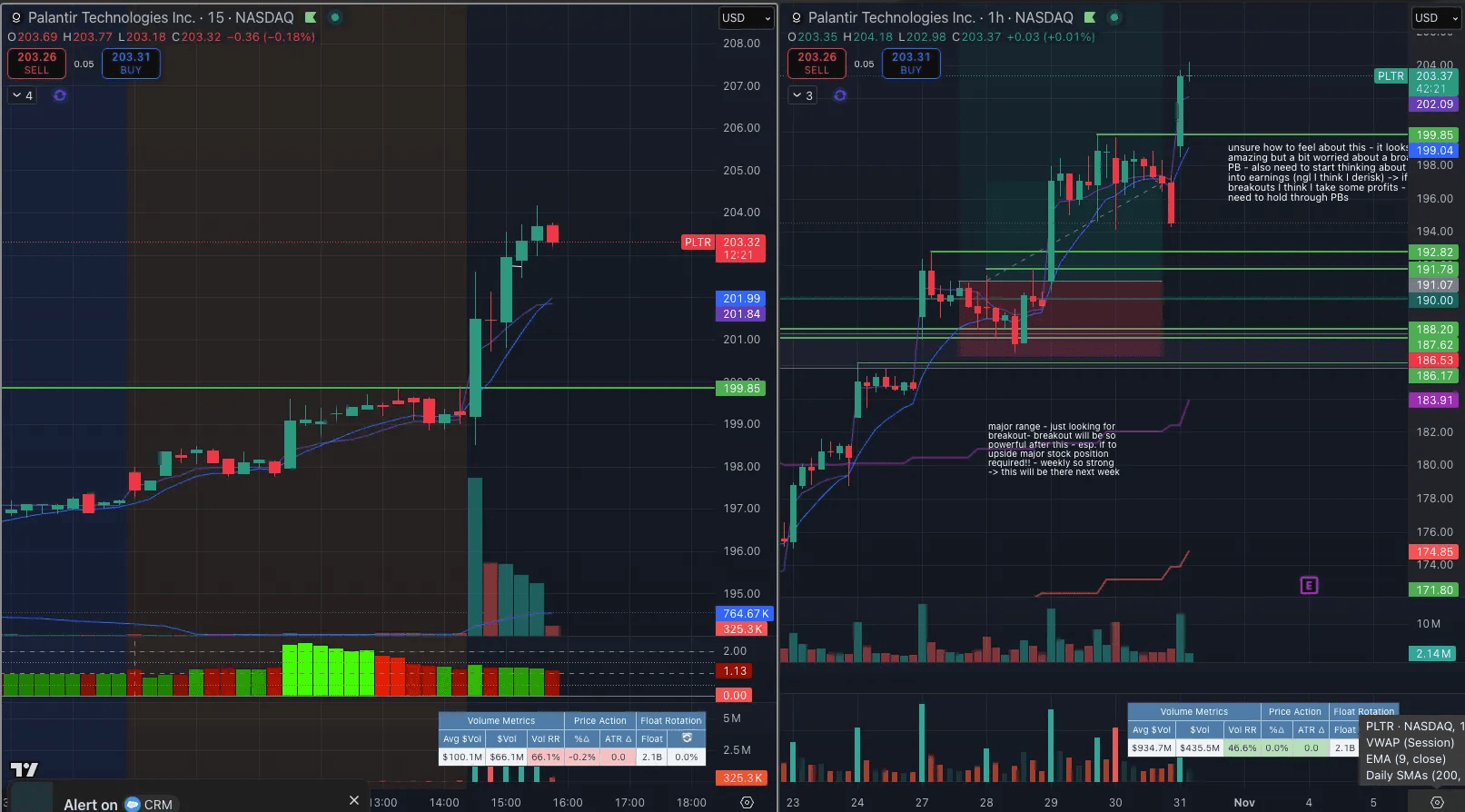

2nd Day

We open the second day flat but the initial move is lower. We can see first hold attempts off the open but the lifts run into VWAP and are stuffed.

We then continue to move, and even close on the hourly, below the highs. At this point, we need to be extra alert to see if this leads to a strong fail below or if we are still holding. As long as we don't fail below further and make a LH below the range highs setting up a failed breakout, I was still confident in the position and continued to hold.

We then see strong buying step in on the new hourly candle, actually leading to the largest volume on the day for an end-of-day move.

This end-of-day move reaffirms the interest of buyers to hold the breakout. It also sets up the strong potential of a daily HL holding the range top on a yHOD break in the next session.

3rd Day

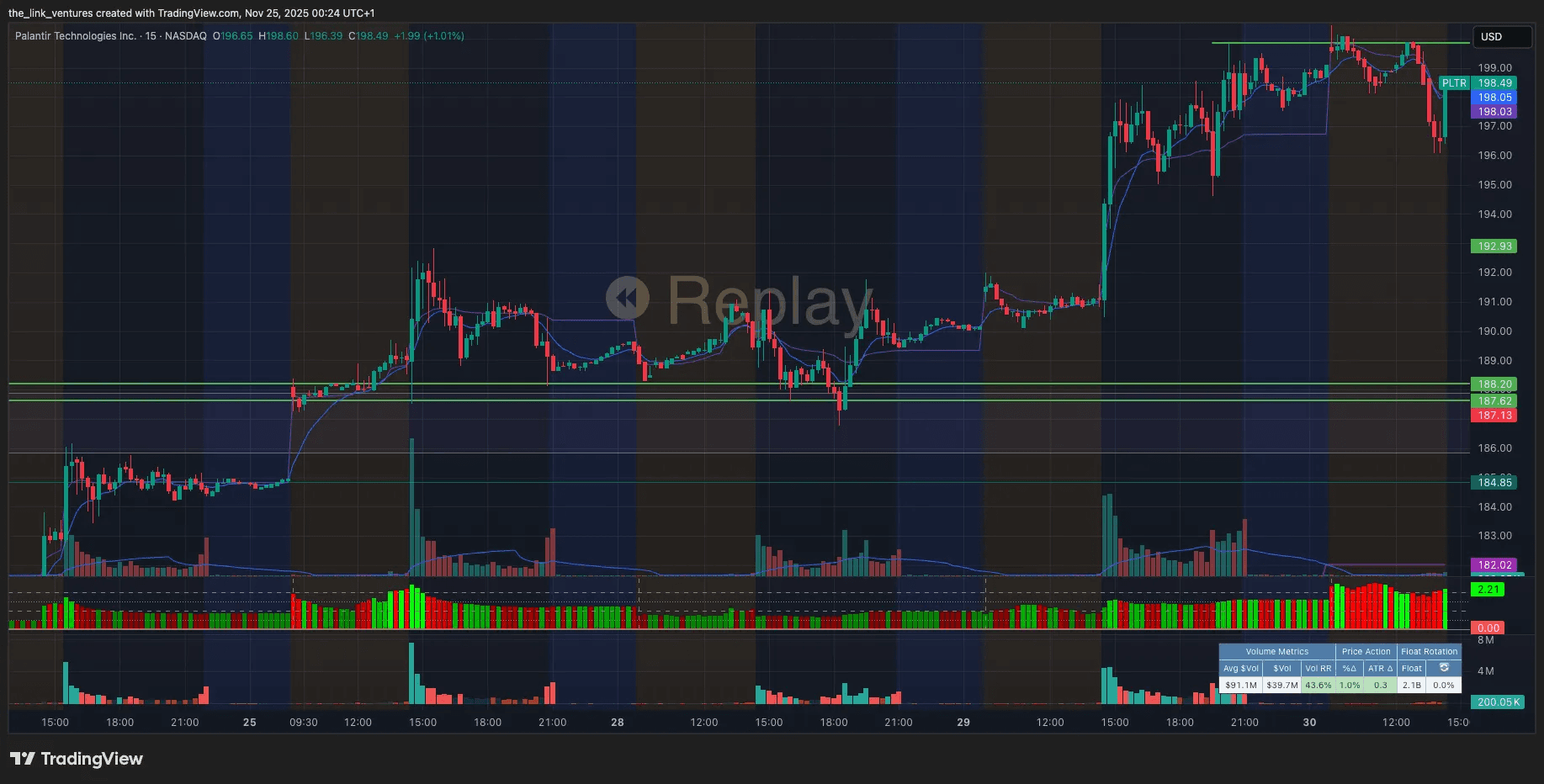

On the 3rd day we can now observe this bullish setup continuing to work out. We see a strong move higher off the open with large buying volume coming in to push up prices.

This then consolidates into the afternoon and is able to hold prices higher, rejecting any attempts at selling lower.

We can also see stronger volume step in into the close which again allows us to maintain confidence in the trade.

The daily candle closes strongly, setting up a further move into ATH. While I remain confident in the trade, there are only 3 more trading sessions pre-earnings report, thus this time constraint needs to be considered for exits of the position.

4th Day

The fourth day proved to be rather uneventful with a lot of chop in the upper range of the prior day.

While this does mean that we are at least accepting higher prices for now, it also shows a lack of immediate continued buying interest.

Nonetheless, we are not seeing stronger sellers step up and the dump into the close is quickly bought up after hours. I still remain in my full position.

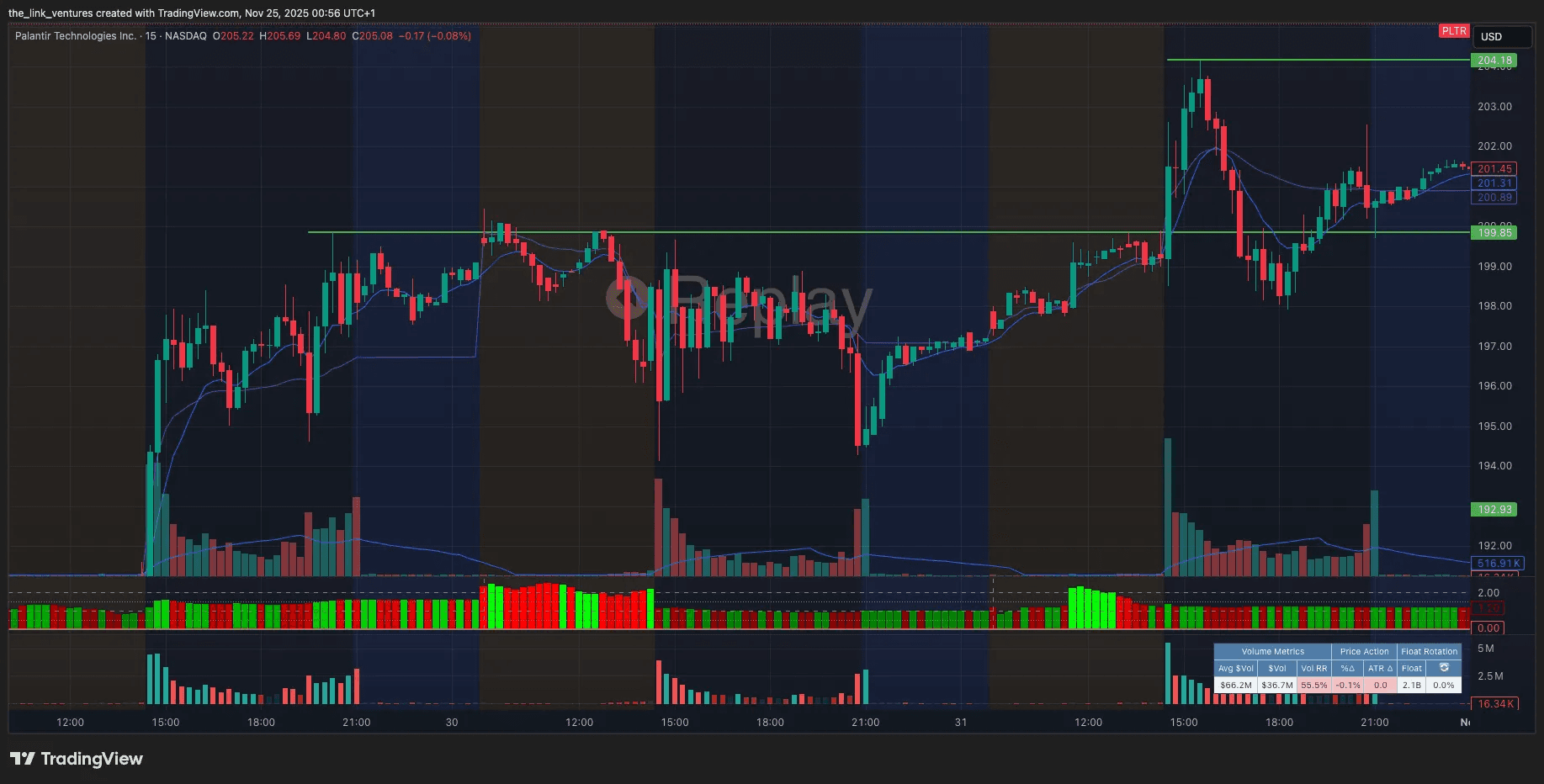

5th Day & 1st Partial Exit

We open the fifth day at yesterday's high. We see a very strong pump off the open with strong volume coming in as we are breaking above yHOD.

Looking at the 5M we can see that we held VWAP nicely and started to move higher again. I decided to take my first exit after we extended higher and the 15M started to slow down and felt like it was going to roll over. Considering we have extended a decent amount from our entry and this is the Friday before earnings on Monday, I was inclined to take the first profits here. We also saw strong asks coming into the market, which PLTR filled but finally struggled to get follow-through above.

This seemed to be the right read as we sold the top of the move and ended up giving back the entire opening move. While we broke the LOD, this was into the prior day's range and held that for a move back above yHOD into the close.

I do believe that I could have exited a bit more of my position into the close as we did not see strong volume come in on the move higher and the daily candle had a strong upper wick. I did like that we regained yHOD but I am not sure if that was enough to hold this through an uncertain weekend.

With that being said, I had exited about 60% of my position on that first partial.

6th and Final Day & Full Position Exit

After the weekend, we open up above yHOD with a strong market open as well. Earnings were going to be reported after the bell, thus I was more aggressively looking for opportunities to exit the position as I didn't want to hold through earnings.

I decided to take the next part of my position off as we clearly struggled to get above ONH with strong wicks appearing on the 5M. We then failed back below yHOD and rejected it from below, at which point I exit more of the position.

I had a smaller remainder position on as we turned around for a move back above yHOD. We saw a very strong close here pre-earnings release and I exited full position on the close. I will discuss the numbers of the trade in the last section.

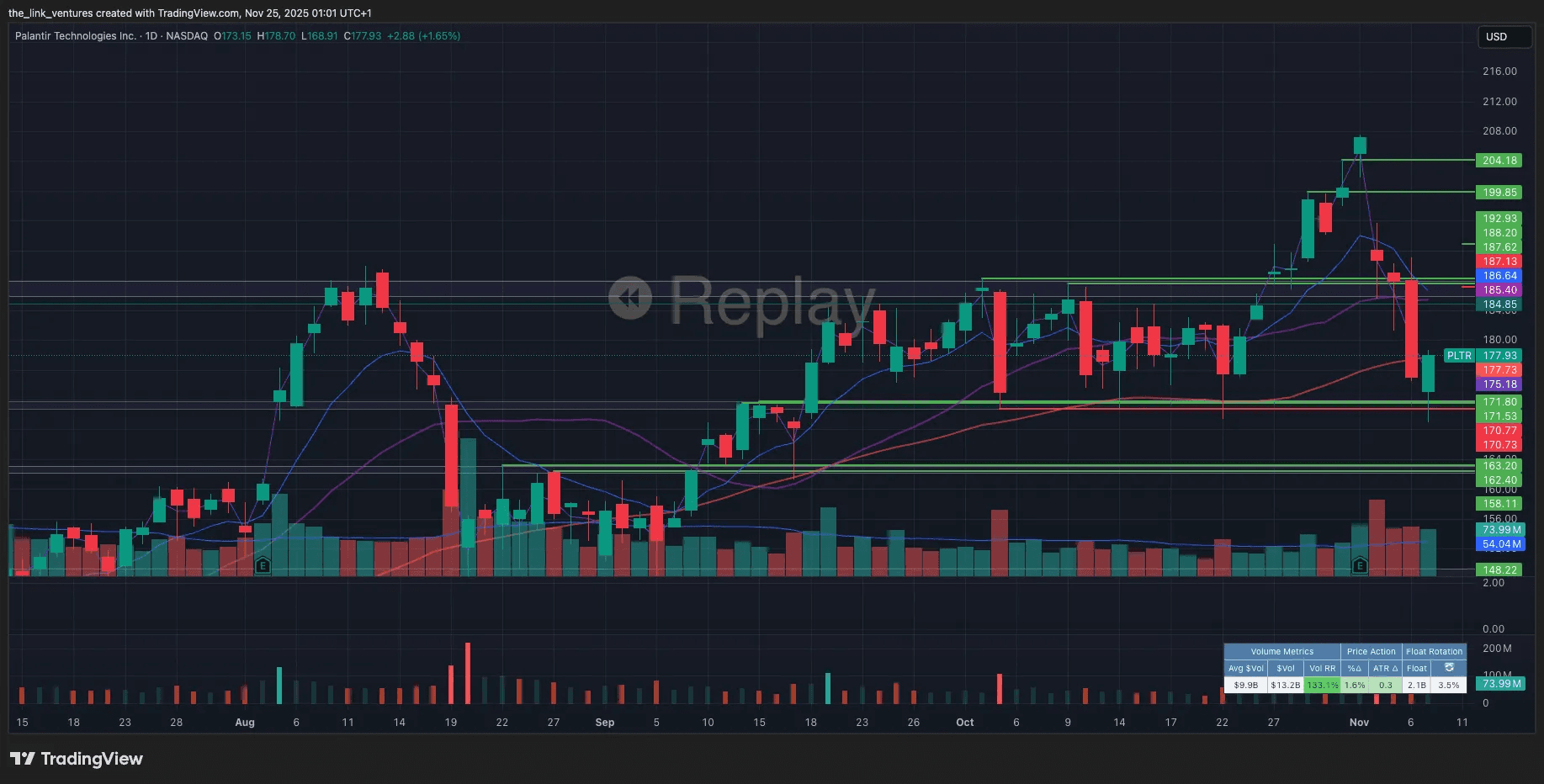

Post-Earnings Reaction and Aftermath

A quick note on the earnings and aftermath. As stated early, given PLTR's extremely high valuation, this earnings report had to be nothing other than perfect to see a positive reaction.

While the numbers were incredible, given the high valuation we sold off after hours after an initial positive pop as algorithms traded on the headline numbers.

We then continued to sell in the coming days. On the post-earnings Tuesday, buyers still tried to hold the range retest but that was rejected the following day on the open. We again tried to hold but saw a strong capitulation and fail back inside during the Thursday session.

Trade Reflection and Grading

Lastly, I want to summarise the trade and evaluate my trade performance.

Trade Thesis/Summary:

PLTR had been in a strong weekly range and then got the gap out of range, coming on the back of a failed breakout to the downside. With earnings coming in one week, we could see a run-up into earnings and breaking into ATH can lead to a short squeeze and new buyers entering positions.

I entered the trade on 27/10/25 trading only PLTR shares. I exited full position one week later on 03/11/25, having taken partials before on 30/10/25 and 31/10/25.

Overall, the trade achieved an overall 5.4% return (last position sold for 7.5%) on around 2.4% of risk, thus achieving a 2.25 R:R. This was likely cut short due to the earnings release as I believe without it PLTR could have continued to trend higher and reach our full target.

For my exits, I am pleased with the exits as they not only came at the right time, but also had a strong mix of letting the trade run while understanding and reading market conditions to secure profits.

While I am not happy about taking an arbitrary exit, like I did for the last (two) exit(s), I believe that it was the right decision to not hold through earnings as truthfully I didn't know enough about this earnings release, other than that anything other than outstanding earnings would likely lead to downside.

In terms of position sizing, I believe I should have gone in with bigger size considering the limited risk. I also believe that given my initial entry, an add to the position would have been advisable as we held the highs on the first two trade days and then made the aggressive move higher for the daily HL on the third day.

This would have allowed me to take on more size at a lower average entry price while also adding to my winner as it made the move higher on Wednesday. This would have strongly improved my return and R:R numbers.

I also believe that the use of options could have been interesting, though considering we were 1 week out from earnings, options premiums were already inflated and the greeks could have caused troubles, especially as the trade took time to work out, during which theta and vega could have caused stronger decay.

Overall, I believe that this was a solid trade. I would rate the initial setup an A setup which developed into a B setup at the end of the first trade day but then turned into an A again as it made the daily HL. While I am pleased with my exits, I believe my entries could be better, both in terms of size and add-ons.

FOOTNOTE

© 2025 TLG Research. All rights reserved. Unauthorised use and/or duplication of this material without express and written permission from this blog’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to [Your Name] with appropriate and specific direction to the original content. Disclaimer: The content provided on this blog is for educational and informational purposes only and does not constitute financial, investment, or trading advice. The author is not a financial advisor. All trading involves a high level of risk and may not be suitable for all investors; do not trade with money you cannot afford to lose. Past performance is not indicative of future results.