Nov 21, 2025

𝄪

Equity Research Reports

𝄪

How Seagate (STX) is transforming from a cyclical storage company to prime AI beneficiary

Seagate ($STX) Equity Research Report

Date: November 21, 2025

Recommendation: LONG (Equity, Leaps, Hedging through Index Puts)

Target Price: $435.14 (68.5%)

Business Description

Seagate Technology Holdings is a global data storage leader, specialising in the design and manufacture of high-capacity hard disk drives (HDDs) for cloud, hyperscale, and enterprise applications. Founded in 1978, Seagate has regularly innovated through key shifts in computing, from the PC era to the rise of cloud and now the AI revolution. Today, hard disk drives (HDDs) store nearly 90% of the massive data volumes residing in large-scale data centres, with Seagate serving as a primary supplier for this critical infrastructure. Over 80% of its revenue comes from supplying mass-capacity drives to major hyperscalers such as Amazon, Google, Meta, and Microsoft, as well as leading enterprise server and storage OEMs.

Seagate is in the midst of commercialising a generational leap in HDD technology with heat-assisted magnetic recording (HAMR). This innovation dramatically increases drive density and capacity, lowers cost per terabyte, and improves efficiency, key for the world’s largest data centre customers who depend on every incremental storage and energy dollar. The company operates as a leader in an effective duopoly with Western Digital, with meaningful scale, technology leadership, and long-term customer relationships. Seagate combines technological know-how with disciplined capital returns, having delivered billions to shareholders in recent years through dividends and buybacks. This positions Seagate at the critical intersection of digital infrastructure, innovation, and value creation.

Investment Thesis

Structural Re-rating and Forward Valuation: Seagate is transitioning from a low-multiple, PC-cycle hardware name to a core AI and data-infrastructure asset, and the valuation should be framed explicitly in forward P/E terms. The stock is currently trading at an elevated P/E level of 34x, but consensus implies a current forward P/E of ~12.7x on FY26, 21.2x on NTM earnings, then 17.6x in FY27, 15.7x in FY28, and 12.0x in FY29 as earnings ramp and the stock grows into its multiple. These levels are elevated versus Seagate’s own long-term average but they are not demanding when viewed against the new growth and margin profile and against AI-linked infrastructure peers that often trade in the mid‑ to high‑teens on forward earnings. The core argument is that historical “cheap” multiples (10–12x) reflected a volatile, PC-refresh–driven, low-visibility business, whereas the current and forward multiples reflect a company with structurally higher growth, better visibility via multi‑quarter hyperscaler contracts, and a more durable position in the AI data stack.

In that context, today’s forward P/Es look less like late‑cycle exuberance and more like the early phase of a structural re-rating toward AI infrastructure–type valuations.HAMR Leadership as Differentiated Moat: Seagate’s technology lead in HAMR underpins the qualitative shift in how the business should be valued. It is the only vendor shipping 30TB+ HAMR drives in volume today, while Western Digital and Toshiba are still relying on transitional technologies and do not expect comparable HAMR volumes until around 2027. This creates a multi‑year window where Seagate uniquely offers the highest‑density, lowest‑cost‑per‑terabyte drives for hyperscalers, translating into both bill‑of‑materials savings (fewer platters and heads per TB) and stronger pricing power in the top‑capacity tiers. This technology differentiation is central to the thesis: it explains why margins can credibly move toward the high‑40% range and why Seagate can capture outsized share of incremental AI‑driven storage demand versus competitors. It also supports the narrative that this is no longer a commodity HDD producer, but a key enabler of AI data infrastructure with a defensible engineering moat.

Capital Efficiency and Self-Funded Growth: A critical but sometimes underappreciated pillar of the thesis is capital efficiency and funding mix. Seagate is financing its CapEx out of operating cash flow, keeping CapEx at roughly mid‑single‑digit percentages of revenue while growing exabytes, and still generating positive and rising free cash flow. There is no need for large equity issuance and no Oracle‑style debt binge to support hyperscale build‑outs; by contrast, Oracle’s cloud and AI data centre push has required CapEx above operating cash flow, leading to negative free cash flow and a sharp increase in net debt. This self-funded model reduces financial risk and increases the option value of the equity: incremental AI demand converts more directly into free cash flow rather than being absorbed by massive upfront infrastructure spending. Combined with the new $5B buyback authorisation, this means Seagate can compound shareholder returns through both earnings growth and consistent share count reduction, reinforcing the case for a sustained re-rating of the multiple over time.

Industry Overview

The global data storage industry is undergoing a profound transformation. Total data creation is forecast to triple, from 132 zettabytes in 2023 to nearly 400 by 2028, driven by the explosion of AI workloads, cloud computing, video, collaboration, and analytics. Roughly 90% of this data in hyperscale centres is stored on HDDs, making the technology the backbone of modern digital society. The incremental demand created by the AI wave is expected to accelerate in coming years. Building, training, and running AI models at scale demands enormous storage for both raw data and model weights, most of which is “cold” or infrequently accessed data, perfectly matching HDDs’ cost and capacity sweet spot. This secular demand backdrop is further strengthened by the roll-out of new technologies like HAMR, which promises even higher density and better economics. Structurally, the HDD industry has consolidated to a rational and stable duopoly between Seagate and Western Digital, with Toshiba a distant third.

Decades of boom-bust cycles have made way for smarter supply discipline, capital allocation, and customer contracting. Hyperscalers now sign multi-quarter, even multi-year supply agreements for greater visibility and stability on both sides.

HDDs enjoy durable cost advantages over flash memory (SSDs), currently 6x cheaper per terabyte, with superior manufacturing capital efficiency. Analysts see HDDs maintaining an ~80% share of hyperscaler and enterprise storage capacity through at least the late 2020s. As a result, sector cyclicality is dampened, margin structures are improving, and the competitive landscape is stable, a fertile setup for sustained growth and business model re-rating.

Competitive Positioning

Seagate’s key competitive advantages stem from its leadership in technology, cost, customer relationships, and capital discipline:

HAMR Technology Leadership: Seagate is years ahead of Western Digital in deploying high-density HAMR drives; it is the first to qualify 30TB and soon 40TB HAMR products at major hyperscalers. This edge translates into clear bill-of-materials savings and margin expansion, and positions Seagate as the only supplier of next-gen drives for the critical early innings of the AI supercycle. Western Digital’s comparable products are unlikely before 2027, and Toshiba remains a distant laggard.

Cost and Margin Edge: Seagate’s manufacturing efficiencies and HAMR advances allow gross margins to climb toward the high 40s, compared to WD’s targets in the upper 30s. This expansion is driven by two factors: 1) Bill-of-materials deflation, as HAMR enables higher capacities with fewer platters and heads, and 2) pricing power from being the sole provider of 30TB+ mass-capacity drives. Per-terabyte costs for HDDs are vastly superior to SSDs, especially as capacity increases, reinforcing Seagate’s centrality for hyperscaler bulk storage.

Customer Stickiness and Share: Over 80% of Seagate’s revenue comes from mass-capacity sales, primarily to hyperscale customers like Amazon, Microsoft, Google, and Meta, who have shifted to long-term "build-to-order" supply contracts that provide multi-quarter visibility. Being first to market with qualified HAMR technology cements these relationships and ensures share gains in the highest-density segments.

Duopoly Discipline: The HDD sector is now a rational duopoly. Price wars and chronic oversupply have given way to multi-quarter planning, stable pricing, and margin rationality. Seagate’s technology lead and capital discipline mean it can potentially capture disproportionate sector profits in the coming cycle.

Barriers to Entry and M&A: The capital, R&D, and supplier relationships required to compete at scale in HDDs make it nearly impossible for new entrants to challenge Seagate or WD in the medium term. Recent acquisitions reinforce Seagate’s technical moat and secure key materials/processes for HAMR rollout.

Competitive Threats: While SSDs are improving, their cost structure and capital intensity limit their competitiveness for most hyperscale workloads. Flash remains a future risk, but one that is slow-moving and currently insulated by cost and capacity economics.

Seagate’s competitive strength is rooted in technology, scale, and supply contracts. Its unique positioning in the AI, data-driven infrastructure boom makes it the sector’s probable outsized winner for the next phase of growth.

Valuation

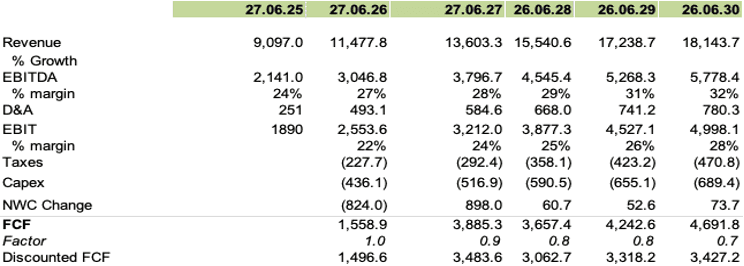

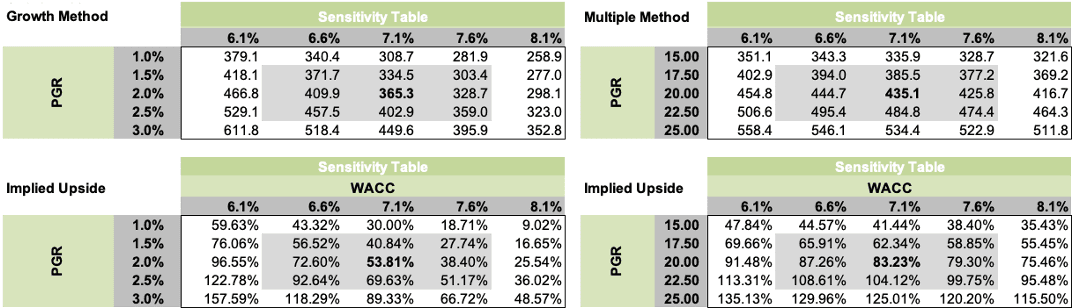

In our DCF, we model revenue growth driven by exabyte expansion and ASP uplifts, avoiding a return to cyclical volatility. We project gross margins expanding to 40% and EBITDA margins to 32% by FY2029, underpinned by HAMR’s bill-of-materials deflation and pricing power. Based on these margin assumptions and a standard terminal growth rate, our DCF implies 54% upside from current levels. Alternatively, applying a target EV/EBITDA multiple of 20x to reflect Seagate’s transition to critical AI infrastructure yields significantly higher upside of 83%.

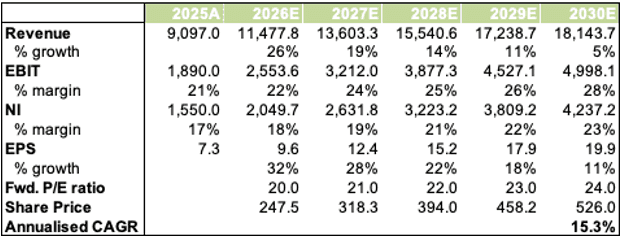

Complementing this, our earnings model implies a 15.3% CAGR in shareholder returns when using a forward P/E approach. This trajectory assumes the valuation converges toward a re-rated 24x forward P/E, consistent with high-growth data center peers, as the market fully prices in the durability of Seagate’s AI-driven earnings profile.

Investment Risks — Fundamental Focus

AI Build-Out Delays/Cancellations: Seagate's growth thesis is tightly linked to the AI infrastructure buildout. If hyperscaler AI investments slow, projects are delayed, or anticipated demand fails to materialise, whether due to economic headwinds, shifting capital priorities, or slower-than-expected AI adoption, Seagate's revenue could fall short of expectations.

Margin Sensitivity: Success is contingent on HAMR yields. If manufacturing complexities arise, the projected margin expansion (and the valuation re-rating) would stall.

Cyclical & Customer Concentration: Revenue remains exposed to "lumpy" hyperscale buying patterns. If a major customer (e.g., Amazon or Google) pauses procurement for a quarter, results can miss consensus. Geopolitical & Supply Chain: With significant exposure to Chinese end-customers (e.g., Tencent, Alibaba) and Asia-based manufacturing, Seagate is vulnerable to potential export controls or trade tariffs that could restrict high-capacity drive sales.

No Multiple Re-rating: Even if Seagate delivers on earnings growth, the market may not re-rate the stock. HDDs have historically traded as a commoditised, cyclical business, and investors may continue applying a discount multiple regardless of improved fundamentals.

Investment Risks — Factor Focus

A Fama–French factor regression (size, value, profitability, investment, and momentum) on Seagate returns indicates that the position introduces very limited style-factor risk beyond market and sector exposure.

Market & Cyclical Risk: Seagate’s beta is elevated, with returns tightly linked to tech sector cycles, market risk appetite, and especially AI/cloud investment trends. In a downturn or sector rotation away from AI infrastructure, STX will likely underperform broader indices. The position is a concentrated bet on sustained strong sector demand.

Size (SMB ≈ -0.04): The loading on the size factor is close to zero and statistically insignificant. This means the position does not introduce a meaningful small-cap or large-cap tilt; it behaves broadly like the market in size terms.

Value (HML ≈ -0.07): The value factor loading is also near zero and insignificant. The position is not a pronounced value or growth bet in factor terms, despite the narrative shift from “old hardware value stock” toward AI infrastructure.

Profitability (RMW ≈ +1.05): The positive, though statistically weak, loading on the profitability factor suggests Seagate trades more like firms with robust operating profitability. This is consistent with the margin expansion and free cash flow story: you are adding exposure to the “quality/profitability” style, but the statistical evidence is not yet strong enough to call it a pure quality factor play.

Investment (CMA ≈ -1.28): The negative loading on the investment factor (Conservative Minus Aggressive) implies Seagate behaves more like “aggressive investors” in the Fama–French sense, companies that reinvest and grow rather than hoard capital. This fits an AI infrastructure build-out narrative. From a risk perspective, on is slightly tilted toward firms that are actively investing for growth, which can underperform in regimes where the market favors conservative balance sheets and minimal capex.

Momentum (MOM ≈ -0.16): The small, negative, and insignificant momentum loading indicates that Seagate does not currently carry a strong momentum premium or anti-momentum bias. The position is not a momentum bet in either direction.

From a style-factor perspective, the Seagate position is largely factor-light once market and sector exposure are hedged, which is desirable for a market-neutral or factor-aware mandate.

Trade Structure

The Core Long: Equity & LEAPS

The primary vehicle for expressing this thesis is a long equity position in Seagate (STX) common stock. This provides direct exposure to the re-rating narrative, HAMR commercialisation, and dividend yield.

For capital efficiency, we also recommend utilising LEAPS (Long-term Equity Anticipation Securities). Deep in-the-money call options (e.g., Jan 2027) offer leveraged exposure with defined downside risk. Given the 12–24 month catalyst window for the HAMR ramp, LEAPS allow investors to capture the full duration of the re-rating cycle with significantly less capital outlay than purchasing the stock outright.

Market Neutral Construction: Index Option Hedging

For investors structuring this as a market-neutral position, hedging via single-stock shorts is challenging due to the lack of clear, viable candidates in the HDD sector (competitors like Western Digital are also potential beneficiaries of the AI cycle).

Therefore, we recommend hedging systematic exposure via Index Put Options. Instrument Selection: Puts on QQQ (Nasdaq-100) or XLK (Technology Select Sector) are the most efficient vehicles. Both indices maintain a high correlation to the AI infrastructure and semiconductor themes driving Seagate’s price action.

This hedge isolates the idiosyncratic return generated by the HAMR monopoly and valuation re-rating, by neutralising the broad beta component.

FOOTNOTE

© 2025 TLG Research. All rights reserved. Unauthorised use and/or duplication of this material without express and written permission from this blog’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to [Your Name] with appropriate and specific direction to the original content. Disclaimer: The content provided on this blog is for educational and informational purposes only and does not constitute financial, investment, or trading advice. The author is not a financial advisor. All trading involves a high level of risk and may not be suitable for all investors; do not trade with money you cannot afford to lose. Past performance is not indicative of future results.